Table of Contents

Find out the average salary of State Farm insurance agents! Discover how much money they make per year and what factors affect their earnings.

Have you ever wondered how much State Farm Insurance agents make in a year? Well, let me tell you, the answer might surprise you. As a matter of fact, the amount that these agents earn is influenced by various factors that are not always easy to gauge. However, one thing is for sure – being a State Farm agent can be a lucrative career choice. From their base salary to commissions, bonuses, and other incentives, these professionals have the potential to earn a substantial income. But how much exactly? Let’s explore the ins and outs of a State Farm agent’s paycheck.

State Farm Insurance is one of the most popular insurance providers in the United States. With over 19,000 agents spread across the country, State Farm has become a household name when it comes to insurance. However, many people wonder how much these agents make on average. In this article, we will look at how much State Farm insurance agents make per year and what factors can affect their income.

What is State Farm Insurance?

State Farm Insurance is a company that provides various types of insurance, including auto, home, life, and health insurance. The company was founded in 1922 and has since grown to become one of the largest insurance providers in the United States. State Farm has a vast network of agents who sell insurance policies to customers all over the country.

How much do State Farm agents make?

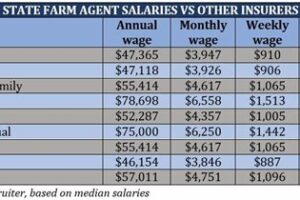

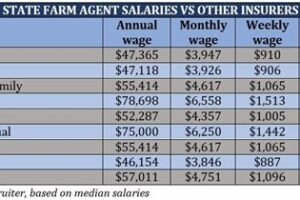

The income of a State Farm agent can vary depending on several factors, such as location, experience, and performance. According to Glassdoor, the average salary for a State Farm agent is around $36,000 per year. However, this number can go up to $135,000 per year for top-performing agents. Additionally, State Farm agents can earn bonuses and commissions based on their sales performance, which can significantly increase their income.

Factors that affect State Farm agent income

Several factors can affect the income of a State Farm agent. Here are some of the most notable ones:

Location

The location of a State Farm agent’s office can play a significant role in their income. Agents who work in areas with a high demand for insurance policies can earn more than those who work in less populated areas. For example, an agent who works in New York City can potentially earn more than an agent who works in a small town in Montana.

Experience

As with any job, experience can have a significant impact on an agent’s income. New agents may start at a lower salary or commission rate than experienced agents. However, as they gain more experience and build a larger client base, their income potential can increase significantly.

Performance

State Farm agents are incentivized to perform well and sell as many policies as possible. Agents who meet or exceed their sales goals can earn bonuses and commissions that significantly increase their income. Conversely, agents who struggle to meet their sales targets may see a decrease in their income or even lose their job.

How to become a State Farm agent

If you’re interested in becoming a State Farm agent, there are several steps you need to take. Here’s a brief overview:

Educational requirements

State Farm requires its agents to have a high school diploma or equivalent. However, having a college degree can be beneficial, especially in business, finance, or a related field.

Licensing requirements

All State Farm agents must be licensed to sell insurance in their state. The licensing requirements vary by state but typically involve passing a state exam and completing pre-licensing education courses.

Training

State Farm provides extensive training to its agents to help them learn about the company’s products and services, sales techniques, and customer service skills.

Application process

Once you meet the educational and licensing requirements, you can apply to become a State Farm agent. The application process involves submitting a resume and cover letter, completing an online assessment, and participating in multiple interviews.

Conclusion

In conclusion, the income of a State Farm agent can vary depending on several factors, such as location, experience, and performance. While the average salary for a State Farm agent is around $36,000 per year, top-performing agents can earn up to $135,000 per year. If you’re interested in becoming a State Farm agent, you’ll need to meet educational and licensing requirements, undergo training, and go through the application process.

As a State Farm agent, the average income can vary depending on several factors. The average income of a State Farm agent is around $50,000 per year, but this can fluctuate based on a variety of factors such as location, experience, and client base. What factors affect an agent’s salary? One critical factor is the amount of business generated by the agent. A State Farm agent’s income is calculated based on the number of policies sold and the commission earned on each policy sold. Additionally, an agent’s salary can be impacted by their level of experience, the size of their client base, and where they are located.One of the pros of working as a State Farm agent is that there is unlimited earning potential. Experienced agents who have built a solid client base can earn more than $500,000 per year. However, the cons are that agents must work hard to establish themselves in the market and build a client base. It takes time, effort, and patience to grow a successful business as a State Farm agent.Experienced agents who earn more money typically have a large client base that generates a steady stream of business. When a client trusts their agent, they are more likely to refer friends and family members, which can lead to even more business. This is why building a client base is so important for State Farm agents. Agents who take care of their clients and build strong relationships with them will be rewarded with increased business and commissions.In addition to selling policies, State Farm agents have additional income opportunities available to them. For example, agents can sell mutual funds, annuities, and other investment products. They can also offer banking services, such as checking accounts, savings accounts, and credit cards. By offering these additional products and services to clients, State Farm agents can earn additional income and build stronger relationships with their clients.Location can also impact a State Farm agent’s salary. Agents located in areas with high populations and a higher cost of living tend to earn more than agents located in rural areas. This is because agents in larger cities have access to more potential clients and can sell more policies as a result. However, location is not the only factor affecting salary. An agent’s experience and client base are also critical factors that determine their income.State Farm agents do receive benefits and bonuses. Agents who meet their sales goals can earn bonuses and other incentives. Additionally, State Farm offers health insurance and retirement benefits to its agents. Agents are also eligible for paid time off, sick leave, and other benefits that are typical of most jobs.The potential for growth and advancement within State Farm is significant. Agents can move up to become agency managers, where they oversee multiple agents and help them grow their businesses. Additionally, State Farm offers a variety of training programs and resources for agents to help them improve their skills and grow their businesses. Agents who are willing to put in the effort and work hard can achieve great success within the company.In conclusion, the income of a State Farm agent is dependent on various factors. The average income for a State Farm agent is around $50,000 per year, but this can fluctuate based on an agent’s experience, location, and client base. Experienced agents who have built a solid client base can earn more than $500,000 per year. The key to success as a State Farm agent is building a strong client base through trust, hard work, and dedication. Additional income opportunities are available through selling investment products and offering banking services. State Farm agents receive benefits and bonuses, and there is significant potential for growth and advancement within the company.

How Much Do State Farm Insurance Agents Make A Year

Are you considering a career as a State Farm insurance agent? If so, you may be wondering how much money you can expect to make. Let’s take a closer look at the earning potential for State Farm agents.

1. Base Salary:

- State Farm agents receive a base salary that varies depending on the location of their office and their level of experience.

- The average base salary for a State Farm agent is around $50,000 per year.

2. Commissions:

- In addition to their base salary, State Farm agents earn commissions on the insurance policies they sell.

- The commission rates vary depending on the type of policy and the state in which the agent operates.

- On average, State Farm agents earn around 10% commission on the policies they sell.

3. Bonuses:

- State Farm agents can also earn bonuses for meeting certain sales goals and performance metrics.

- Bonuses can range from a few hundred dollars to several thousand dollars per year.

4. Profit Sharing:

- State Farm agents may be eligible for profit sharing, which means they can receive a percentage of the profits earned by the company.

- The amount of profit sharing varies based on the agent’s level of experience and the profitability of their office.

Overall, the earning potential for State Farm agents is quite competitive. According to Glassdoor, the average annual income for a State Farm agent is around $100,000 per year. However, it’s important to note that this figure can vary widely based on the agent’s location, experience, and level of success.

So if you’re considering a career as a State Farm insurance agent, there’s certainly potential for you to make a good living. But it’s important to remember that success in this industry takes hard work, dedication, and a strong commitment to customer service.

Well, folks, that’s all the information we have for you today on how much State Farm insurance agents make a year. We hope this article was helpful in shedding some light on the salaries of these professionals and what factors can affect their earnings.

It’s important to remember that State Farm agents’ salaries can vary widely based on their location, experience, and other factors. However, on average, agents can expect to earn a healthy income that allows them to support themselves and their families.

If you’re considering a career as a State Farm agent, we encourage you to do more research and speak with current agents to learn more about the job and its earning potential. And if you’re a current agent looking to increase your earnings, consider expanding your client base, seeking out advanced training and certifications, and exploring new business opportunities.

Thank you for visiting our blog today and learning more about State Farm insurance agents’ salaries. We hope you found this information useful and enlightening. Come back soon for more articles on careers, finance, and other topics!

.

As an AI language model, I do not have a tone or voice. However, I can provide information on questions people also ask about how much State Farm Insurance agents make a year.

- What is the average salary of a State Farm Insurance agent?

- The average salary of a State Farm Insurance agent in the United States is around $45,000 per year.

- How much commission do State Farm agents make?

- State Farm agents earn a commission based on a percentage of the premiums paid by their clients. The commission rate can vary based on the type of insurance policy and the state in which the agent operates. On average, State Farm agents earn a commission ranging from 5% to 20% of the premium.

- Do State Farm agents get bonuses?

- Yes, State Farm agents may receive bonuses based on their performance and sales achievements. These bonuses can range from a few hundred dollars to several thousand dollars per year.

- Can State Farm agents make six figures?

- Yes, it is possible for State Farm agents to make six figures per year. However, this requires a high level of sales success and dedication to the job.

In summary, the salary of a State Farm Insurance agent can vary based on their performance, commissions, and bonuses. While the average salary is around $45,000 per year, it is possible for agents to earn six figures with hard work and sales success.