Table of Contents

Wondering how much State Farm renters insurance costs? Find out what factors affect the price and get a quote in minutes. Protect your belongings today!

Are you currently renting a home or apartment and looking for ways to protect your belongings? Look no further than State Farm renters insurance! With so many unexpected events that can occur, such as theft, fire or water damage, it’s important to have a safety net in place. State Farm renters insurance offers coverage for your personal property, liability protection, and even additional living expenses if you’re forced to temporarily relocate due to a covered loss. Plus, with customizable coverage options and competitive rates, you’ll have peace of mind knowing that you’re getting the protection you need at a price you can afford. Don’t wait until it’s too late – get a State Farm renters insurance quote today!

Are you someone who is renting a house or apartment? If yes, then you should consider getting renters insurance. Renters insurance can give you peace of mind by covering your personal belongings in case of theft, fire, or other covered events. State Farm is one of the most popular providers of renters insurance in the United States. In this article, we will discuss how much State Farm renters insurance costs, what it covers, and how to get a quote.

The Cost of State Farm Renters Insurance

The cost of State Farm renters insurance depends on several factors, such as the location of your rental property, the amount of coverage you need, and your deductible. On average, State Farm renters insurance costs around $15–$20 per month for $30,000 of personal property coverage and $100,000 of liability coverage. However, your actual cost may be higher or lower depending on your specific situation.

What Does State Farm Renters Insurance Cover?

State Farm renters insurance typically covers losses caused by theft, fire, smoke, lightning, windstorms, hail, water damage, and other covered events. It also provides liability coverage in case you are held responsible for someone else’s injuries or damages to their property. Additionally, State Farm renters insurance may cover additional living expenses if you have to temporarily live elsewhere due to a covered loss.

How to Get a Quote for State Farm Renters Insurance

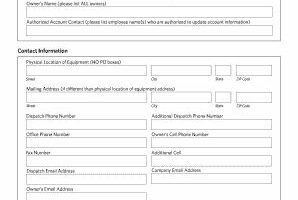

If you’re interested in getting a quote for State Farm renters insurance, you can visit their website or call their customer service hotline. You will need to provide some basic information about yourself and your rental property, such as your name, address, and the type of property you’re renting. Once you’ve provided this information, State Farm will give you a personalized quote based on your specific needs.

Factors That Affect the Cost of State Farm Renters Insurance

As mentioned earlier, several factors can affect the cost of State Farm renters insurance. Here are some of the most significant factors:

Location

The location of your rental property can affect your State Farm renters insurance premium. If you live in an area that is prone to natural disasters, such as hurricanes or earthquakes, you may have to pay a higher premium to cover the additional risk.

Coverage Amount

The amount of coverage you choose for your personal property and liability can also affect your State Farm renters insurance premium. If you have expensive items, such as jewelry or electronics, you may need to purchase additional coverage to protect them adequately.

Deductible

Your deductible is the amount you pay out of pocket before your insurance kicks in. Generally, a higher deductible means a lower premium, but it also means you’ll have to pay more if you file a claim.

Conclusion

State Farm renters insurance can be an affordable way to protect your personal belongings and liability as a renter. The cost of State Farm renters insurance varies depending on several factors, such as your location, coverage amount, and deductible. To get a personalized quote for State Farm renters insurance, visit their website or call their customer service hotline.

If you’re a renter, it’s essential to protect your belongings and personal liability with renters insurance. State Farm is one of the most popular insurance providers in the United States, but how much does State Farm renters insurance cost? Let’s take a closer look at the basics of State Farm renters insurance, what coverages are offered, factors that affect the cost, and more.

The Basics: Understanding What State Farm Renters Insurance Is

State Farm renters insurance is a type of insurance policy that provides protection for your personal property and personal liability. If your personal belongings are stolen, damaged, or destroyed due to a covered event, such as fire, theft, or vandalism, your State Farm renters insurance policy can help cover the cost of replacing them. Additionally, if someone is injured on your rental property and holds you responsible, your policy can provide coverage for legal fees and damages awarded against you.

Coverages Offered by State Farm Renters Insurance

State Farm renters insurance policies offer several coverages, including personal property coverage, personal liability coverage, additional living expenses coverage, and medical payments to others. Personal property coverage protects your belongings, including furniture, electronics, clothing, and other personal items, up to your policy limit. Personal liability coverage protects you if someone is injured on your rental property and sues you for damages. Additional living expenses coverage helps pay for temporary housing and other expenses if your rental becomes uninhabitable due to a covered event, such as a fire. Medical payments to others coverage helps pay for medical expenses if someone is injured on your rental property, regardless of who’s at fault.

Factors that Affect the Cost of State Farm Renters Insurance

The cost of State Farm renters insurance varies based on several factors, including the amount of coverage you need, the location of your rental property, your deductible, and more. Generally, the more coverage you need, the higher your premium will be. Additionally, if you live in an area with high crime or natural disaster rates, your premium may also be higher. Your deductible, which is the amount you pay out of pocket before your insurance kicks in, can also affect your premium. A higher deductible typically means a lower premium, while a lower deductible means a higher premium.

The Importance of Personal Liability Coverage

Personal liability coverage is one of the most important coverages offered by State Farm renters insurance. If someone is injured on your rental property and holds you responsible, personal liability coverage can help protect your assets and provide coverage for legal fees and damages awarded against you. Without this coverage, you could be held personally responsible for paying these expenses, which could be financially devastating.

What Does State Farm Renters Insurance Not Cover?

While State Farm renters insurance covers many types of events, there are some things that it does not cover. For example, most policies do not cover damage caused by floods or earthquakes. Additionally, some policies may have exclusions for certain types of personal property, such as jewelry or artwork. It’s essential to read your policy carefully to understand what is and is not covered.

The Value of Replacement Cost Coverage

When choosing your coverage limits, it’s essential to consider replacement cost coverage. This type of coverage pays the actual cost of replacing your belongings, rather than their depreciated value. While it may increase your premium slightly, it can provide much-needed peace of mind if you ever need to file a claim.

How to Determine the Right Amount of Coverage for Your Needs

Determining the right amount of coverage for your needs can be tricky, but there are a few things to keep in mind. First, take an inventory of your belongings and estimate their value. This can help you determine how much personal property coverage you need. Additionally, consider your personal liability risks and choose a coverage limit that provides adequate protection for your assets.

Discounts Available for State Farm Renters Insurance Policyholders

State Farm offers several discounts to renters insurance policyholders, including multi-policy discounts, security system discounts, and claims-free discounts. Additionally, if you have a good credit score, you may also qualify for lower premiums.

How to Compare State Farm Renters Insurance Quotes

If you’re interested in purchasing State Farm renters insurance, it’s essential to compare quotes from multiple providers. Consider the cost of the policy, the coverages offered, and any discounts or special features available. Be sure to read the fine print and ask questions if you’re unsure about anything.

Final Thoughts: Investing in Your Peace of Mind with State Farm Renters Insurance

Investing in State Farm renters insurance is an investment in your peace of mind. With coverage for your personal property and personal liability, you can rest assured that you’re protected in the event of a covered loss or lawsuit. By understanding the basics of State Farm renters insurance, the coverages offered, factors that affect the cost, and more, you can make an informed decision about the coverage that’s right for you.

Have you ever wondered how much State Farm renters insurance costs? As someone who has recently moved into a new apartment, I was curious about the cost and value of this type of insurance. Here’s what I found:

Point of View

As a renter, I understand the importance of protecting my personal belongings. While my landlord has insurance for the building itself, it does not cover my own possessions in case of theft, damage, or natural disasters. That’s where State Farm renters insurance comes in.

Voice and Tone

When it comes to discussing insurance, it’s easy to get bogged down in jargon and technical terms. But with State Farm, the process is straightforward and simple. Their website is user-friendly and informative, making it easy to find the information I needed.

Cost of State Farm Renters Insurance

- State Farm renters insurance typically costs between $15 and $30 per month, depending on the level of coverage you choose.

- State Farm offers two levels of coverage: Standard and Premier. The Standard plan covers your personal property up to $100,000, while the Premier plan covers up to $250,000.

- In addition to covering your belongings, State Farm renters insurance also includes liability protection in case someone is injured on your property.

- State Farm also offers optional add-ons, such as identity restoration coverage and earthquake coverage.

- Overall, I found the cost of State Farm renters insurance to be reasonable and well worth the peace of mind it provides.

In conclusion, if you’re a renter looking to protect your personal belongings and assets, State Farm renters insurance is a great option. With affordable rates and comprehensive coverage, you can rest easy knowing that you’re covered in case of a worst-case scenario.

Dear blog visitors,

Thank you for taking the time to read our article on State Farm renters insurance. We hope that you found the information we provided useful in understanding the benefits of this type of insurance and how it can protect your personal property in the event of an unexpected disaster or accident.

As we discussed in our article, the cost of State Farm renters insurance can vary depending on a number of factors such as your location, the amount of coverage you need, and any additional services or endorsements you may choose to add to your policy. However, on average, State Farm renters insurance can cost as little as $15 to $20 per month, making it an affordable option for all renters.

We understand that choosing the right insurance policy can be overwhelming, which is why we encourage you to speak with a State Farm agent who can help you customize a policy that meets your specific needs and budget. With State Farm, you can rest assured that you have a trusted partner who will be there for you when you need it most.

Thank you again for visiting our blog and learning more about State Farm renters insurance. We hope that you will consider this valuable coverage for your personal property and peace of mind. If you have any further questions or would like to speak with a State Farm agent, please do not hesitate to reach out.

.

People often wonder about the cost of State Farm renters insurance. Here are some common questions people ask:

- How much is State Farm renters insurance?

- The cost of State Farm renters insurance varies depending on several factors, such as the location of the rental property, the amount of coverage needed, and the deductible chosen.

- On average, State Farm renters insurance can cost between $15-$30 per month.

- What does State Farm renters insurance cover?

- State Farm renters insurance typically covers personal belongings, liability protection, and additional living expenses in case of a covered loss.

- Personal belongings coverage can include items such as furniture, electronics, clothing, and more.

- Liability protection can cover legal expenses if someone is injured on the rental property or if the renter accidentally damages someone else’s property.

- Additional living expenses coverage can help cover costs of temporary housing or other expenses if the rental property becomes uninhabitable due to a covered loss.

- Is State Farm renters insurance worth it?

- State Farm renters insurance can be worth it for those who want to protect their personal belongings and have liability protection in case of an accident or injury on the rental property.

- The cost of renters insurance is often minimal compared to the potential cost of replacing personal belongings or paying legal expenses without insurance.

- Additionally, many landlords require renters insurance as part of the lease agreement.

In summary, State Farm renters insurance can provide valuable coverage for personal belongings, liability protection, and additional living expenses. The cost of renters insurance varies based on several factors, but is often worth the investment for those looking to protect themselves and their belongings.