Table of Contents

State Farm full coverage includes liability, collision, and comprehensive insurance. Protect your car from accidents, theft, and damage.

When it comes to auto insurance, State Farm Full Coverage is a popular choice for many drivers. This comprehensive coverage offers protection for both you and your vehicle in the event of an accident or other covered incident. But what exactly does State Farm Full Coverage entail? Let’s take a closer look.

Firstly, State Farm Full Coverage includes liability insurance, which covers damages or injuries you may cause to other people or their property while driving. This can help protect you from costly lawsuits and legal fees. Additionally, it also includes collision coverage, which covers damage to your own vehicle in the event of an accident with another vehicle or object. And last but not least, it also provides comprehensive coverage, which covers non-collision events such as theft, vandalism, or natural disasters.

But that’s not all – State Farm Full Coverage also offers a range of optional coverages that you can add to your policy for even greater protection. These include roadside assistance, rental reimbursement, and even custom parts and equipment coverage for those who have made modifications to their vehicles. With so many options available, State Farm Full Coverage truly allows you to customize your policy to fit your individual needs and budget.

So whether you’re a new driver or a seasoned veteran, State Farm Full Coverage is definitely worth considering when shopping for auto insurance. With its comprehensive protection and flexible options, you can rest easy knowing that you and your vehicle are in good hands.

State Farm Full Coverage is an insurance policy that provides comprehensive protection to drivers. It covers a wide range of incidents, including accidents, theft, and damage to your own vehicle. But what exactly does it entail?

What Does State Farm Full Coverage Include?

- Liability coverage: This covers the cost of damages you may cause to another person’s property or injuries they may sustain in an accident.

- Collision coverage: This pays for damages to your own vehicle in the event of a collision with another car or object.

- Comprehensive coverage: This covers non-collision incidents such as theft, vandalism, or damage caused by natural disasters.

- Uninsured/Underinsured Motorist Coverage: This provides coverage in case you are involved in an accident with someone who doesn’t have enough or any insurance.

Why Choose State Farm Full Coverage?

Choosing State Farm Full Coverage insurance means you can have peace of mind on the road. It offers extensive protection against various scenarios that could potentially cause financial harm.

Moreover, State Farm has a reputation for providing excellent customer service and making the claims process as smooth as possible. With a State Farm Full Coverage policy, you can rest assured knowing that you and your vehicle are well-protected.

Conclusion

State Farm Full Coverage is a comprehensive insurance policy that offers extensive protection to drivers. It includes liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Choosing State Farm Full Coverage means you can have peace of mind on the road, knowing that you and your vehicle are well-protected.

Thank you for taking the time to visit our blog and learn more about State Farm Full Coverage. We hope that the information we provided has been helpful in understanding what this type of coverage entails and how it can benefit you as a policyholder.As we mentioned earlier, State Farm Full Coverage is a comprehensive insurance policy that includes a variety of different types of coverage, including liability, collision, and comprehensive coverage. This means that you can rest assured that you are protected in the event of an accident, no matter what the circumstances may be.In addition to the peace of mind that comes with knowing you have full coverage, State Farm also offers a variety of other benefits for policyholders. These include 24/7 customer support, a convenient mobile app that allows you to manage your policy on-the-go, and access to a network of trusted repair shops and service providers.If you’re interested in learning more about State Farm Full Coverage or are ready to get started with a policy of your own, we encourage you to reach out to one of our agents today. They will be happy to answer any questions you may have and help you find the policy that best fits your needs and budget.Once again, thank you for visiting our blog and we hope that you found the information we provided to be informative and useful. We wish you all the best in your search for the right insurance policy and look forward to serving you as a valued State Farm policyholder..

People Also Ask: What Is State Farm Full Coverage?

If you’re shopping for car insurance, you may have come across the term full coverage. But what does it actually mean? Here are some of the most common questions people ask about State Farm full coverage:

- What does State Farm full coverage include?

- Is State Farm full coverage required by law?

- How much does State Farm full coverage cost?

- Is State Farm full coverage worth it?

- How do I get State Farm full coverage?

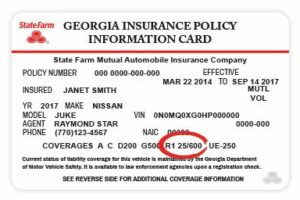

State Farm full coverage typically includes liability coverage, collision coverage, and comprehensive coverage. Liability coverage pays for damages and injuries you may cause to others in an accident. Collision coverage pays for damages to your own vehicle in an accident. Comprehensive coverage pays for damages to your vehicle that are not caused by an accident, such as theft, vandalism, or weather-related damage.

No, State Farm full coverage is not required by law. However, if you have a car loan or lease, your lender may require you to have full coverage to protect their investment.

The cost of State Farm full coverage varies based on several factors, including your age, driving record, location, and the type of vehicle you drive. Generally, full coverage is more expensive than liability-only coverage, but it also provides more protection.

Whether or not State Farm full coverage is worth it depends on your individual situation. If you have a newer or expensive vehicle, full coverage can provide peace of mind and financial protection in case of an accident or other damage. However, if you have an older or less valuable vehicle, you may be able to save money by only carrying liability coverage.

To get State Farm full coverage, you’ll need to contact a State Farm agent and request a quote. The agent will ask you questions about your driving history, vehicle, and insurance needs to help you select the right coverage options. You can also customize your coverage with additional options, such as roadside assistance or rental car reimbursement.

Overall, State Farm full coverage can provide valuable protection for your vehicle and finances. However, it’s important to review your individual needs and budget to determine the right level of coverage for you.