Table of Contents

Curious about State Farm insurance brokers’ salaries? Learn how much they make, including factors that can affect their earnings.

Are you curious about the earning potential of State Farm insurance brokers? Well, buckle up because we’re about to dive into the figures and factors that determine their salaries. From commission-based compensation to location and experience, there are various variables that can impact the income of a State Farm insurance broker. But one thing is for sure, this profession can be highly lucrative for those who excel in sales and customer service. So, let’s take a closer look at how much State Farm insurance brokers make and what it takes to succeed in this competitive industry.

What is State Farm?

Before we dive into the salaries of State Farm insurance brokers, let’s first understand what State Farm is. State Farm is an insurance company that was founded in 1922. It is headquartered in Bloomington, Illinois and offers a wide range of insurance products including auto, home, life, and health insurance.

What does a State Farm insurance broker do?

A State Farm insurance broker sells insurance policies to customers. They work with individuals and businesses to assess their insurance needs and recommend policies that will provide the appropriate coverage. Insurance brokers may also be responsible for processing claims and helping clients navigate the claims process.

How much do State Farm insurance brokers make?

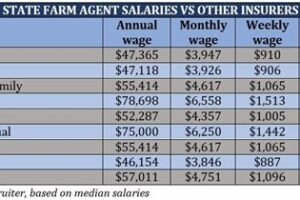

The salary of a State Farm insurance broker can vary depending on a number of factors including experience, location, and performance. According to Glassdoor, the average salary for a State Farm insurance agent is $44,000 per year. However, it is important to note that this is just an average and some agents may make more or less than this amount.

Commission-based pay structure

One thing to keep in mind when considering the salary of a State Farm insurance broker is that they are typically paid on a commission basis. This means that their pay is based on the number of policies they sell and the premiums associated with those policies. Commission rates can vary depending on the type of policy and the company’s compensation structure.

Additional compensation

In addition to their base salary and commission, State Farm insurance brokers may also be eligible for additional compensation such as bonuses or incentives. These bonuses and incentives may be based on performance or meeting certain sales goals.

Training and licensing requirements

Before becoming a State Farm insurance broker, you must complete training and obtain the necessary licenses. State Farm provides training for its agents which includes both classroom instruction and on-the-job training. In addition, insurance brokers must have a state-issued insurance license in order to sell insurance policies.

Career growth opportunities

State Farm offers a variety of career growth opportunities for its insurance brokers. Agents may be able to advance to higher-level positions within the company such as a sales leader or agency manager. In addition, State Farm offers a number of resources for agents to help them grow their business and increase their earnings potential.

Job outlook

The job outlook for insurance brokers is positive. According to the Bureau of Labor Statistics, employment of insurance sales agents is projected to grow 5 percent from 2019 to 2029. This growth is attributed to an increasing demand for insurance products and services.

Conclusion

State Farm insurance brokers have the potential to earn a decent salary through their base pay and commission. They also have opportunities for additional compensation and career growth. If you are interested in becoming a State Farm insurance broker, be prepared to complete the necessary training and licensing requirements. The job outlook for insurance brokers is positive, making it a viable career option for those who are interested in sales and customer service.

A Rewarding Career Choice: Exploring the Income of State Farm Insurance Brokers

When considering a career in insurance, one of the most common questions is, How much do State Farm Insurance brokers make? The answer to this question is not straightforward and depends on various factors. In this article, we will explore the ins and outs of a State Farm Insurance broker’s salary, including the determining factors of their paycheck, the role of seniority in their earnings, and regional disparities across the nation.

Understanding the Determining Factors of a State Farm Insurance Broker’s Paycheck

A State Farm Insurance broker’s income is determined based on several factors. The most significant factor is their sales performance. The more policies they sell, the more commission they earn. Additionally, the number of years they have worked with the company and their level of education also play a role in determining their paycheck.

The Role of Seniority in the Earnings of State Farm Insurance Brokers

Seniority plays a significant role in the earnings of State Farm Insurance brokers. As brokers gain experience and build a client base, they become better at selling policies, leading to increased commissions. Moreover, senior brokers may receive bonuses or incentives for meeting sales targets, which can significantly boost their income.

Regional Disparities: An Overview of State Farm Insurance Broker Wages Across the Nation

The wages of State Farm Insurance brokers vary significantly across the nation, with some regions paying significantly higher than others. For instance, brokers working in California earn an average of $64,000 annually, while those in Texas earn $48,000. Additionally, brokers working in urban areas tend to earn more than those in rural areas due to higher demand for insurance policies in cities.

The Impact of Sales Performance on the Income of State Farm Insurance Brokers

As mentioned earlier, the most significant factor that determines a State Farm Insurance broker’s income is their sales performance. The more policies they sell, the more commission they earn. Furthermore, brokers who consistently meet or exceed their sales targets may be eligible for bonuses or incentives, which can significantly boost their earnings.

The Benefits of Working as a State Farm Insurance Broker: Beyond the Base Salary

Working as a State Farm Insurance broker offers several benefits beyond the base salary. These include flexible work hours, opportunities for career advancement, and access to health insurance and retirement plans. Additionally, brokers get to build relationships with clients and help them protect their assets while earning a living.

The Relationship between Education and Income for State Farm Insurance Brokers

A State Farm Insurance broker’s level of education plays a role in determining their income. Brokers with higher levels of education tend to earn more than those with only a high school diploma. Moreover, some brokers may be eligible for higher commissions if they hold advanced degrees such as a master’s or a Ph.D.

Exploring the Possibility of Commission-Based Income for State Farm Insurance Brokers

State Farm Insurance brokers earn their income primarily through commissions. This means that their income is directly tied to their sales performance. While this may seem like a disadvantage, it also means that brokers have the potential to earn significantly more than their base salary if they excel at selling policies.

Beyond the Numbers: The Personal and Professional Growth that Comes with State Farm Insurance Broker Compensation

Working as a State Farm Insurance broker not only offers financial rewards but also personal and professional growth. Brokers gain experience in sales, customer service, and risk management, which can be valuable in various other industries. Additionally, brokers often receive training and support from the company to improve their skills and stay up-to-date with industry trends.

In conclusion, working as a State Farm Insurance broker can be a rewarding career choice. While their income is primarily commission-based, brokers have the potential to earn significantly more than their base salary if they excel at selling policies. Moreover, brokers enjoy several benefits beyond the base salary, including flexible work hours, opportunities for career advancement, and access to health insurance and retirement plans. Finally, brokers gain valuable experience in sales, customer service, and risk management that can be beneficial in various other industries.

Once upon a time, there was a curious person who wondered, How much do State Farm insurance brokers make? This question led them down a path of investigation and discovery.

Here are some key points and insights about the salary of State Farm insurance brokers:

- State Farm insurance brokers can earn a base salary of around $30,000 to $50,000 per year.

- In addition to their base salary, brokers can also earn commissions and bonuses based on their sales performance.

- The amount of commission and bonus pay can vary depending on the broker’s experience, expertise, and the type of insurance policies they sell.

- Some brokers may specialize in selling certain types of insurance, such as auto, home, life, or health insurance, which can affect their earning potential.

- Brokers who work for State Farm may also be eligible for additional benefits, such as health insurance, retirement plans, and paid time off.

Overall, the amount that State Farm insurance brokers make can depend on a variety of factors, including their level of expertise, their sales performance, and the types of insurance policies they sell. However, with hard work and dedication, many brokers can earn a comfortable living and enjoy the rewards of helping people protect their assets and achieve their financial goals.

Greetings to all my readers! Before we part ways, I want to share some final thoughts on the topic of State Farm Insurance brokers’ salaries. It’s been a fascinating journey, delving into the intricacies of this career field and examining various factors that can impact earnings.

One thing that’s abundantly clear is that there’s no simple answer to the question of how much State Farm Insurance brokers make. As we’ve seen, there are many variables at play, ranging from location and experience level to commission structures and performance incentives.

However, despite the complexity of the issue, I hope this article has provided you with some valuable insights and a better understanding of what to expect if you’re considering a career as a State Farm Insurance broker. While there’s no guaranteed path to riches in this field, it’s clear that there are opportunities for those who are willing to put in the effort and build their skills and networks over time.

Finally, I’d like to express my gratitude to all of you for taking the time to read this article and engage with me on this important topic. Whether you’re a seasoned insurance professional or just starting out, I hope you found something of value here and that you’ll continue to explore the fascinating world of insurance as you move forward in your career. Until next time, take care and keep learning!

.

People also ask about how much State Farm insurance brokers make. Well, here are some answers that might help:

-

What is the average salary of a State Farm insurance broker?

The average salary of a State Farm insurance broker is around $45,000 to $50,000 per year. However, this may vary depending on the broker’s location, experience, and performance.

-

How do State Farm insurance brokers get paid?

State Farm insurance brokers get paid through commission-based earnings. They earn a percentage of the premiums that their clients pay for their insurance policies. The more policies they sell and renew, the more commissions they can earn.

-

What benefits do State Farm insurance brokers receive?

State Farm insurance brokers receive various benefits, including health insurance, retirement plans, paid time off, and bonuses. Some brokers may also receive additional incentives for meeting or exceeding their sales goals.

-

Is it worth becoming a State Farm insurance broker?

Becoming a State Farm insurance broker can be a lucrative career choice for those who enjoy sales and customer service. However, it requires hard work, dedication, and a willingness to learn and adapt to changes in the insurance industry.

In summary, State Farm insurance brokers can earn a decent salary through commission-based earnings. They also receive various benefits and incentives for meeting their sales goals. Overall, becoming a State Farm insurance broker can be a rewarding career choice for those who are willing to put in the effort and commit to providing excellent service to their clients.