Table of Contents

State Farm’s Good Driver Discount can save you up to 25% on car insurance. Find out how much you could save and start driving with confidence today!

Are you a good driver but still paying high car insurance rates? State Farm’s Good Driver Discount may be the solution you’ve been looking for. This discount is designed to reward safe drivers who have a clean driving record, and it can save you up to 25% on your car insurance premiums. But just how much is State Farm’s Good Driver Discount worth, and how do you qualify for it? Let’s take a closer look.

Firstly, it’s important to note that the exact amount of savings you’ll receive from the Good Driver Discount will vary depending on a number of factors, including your age, location, and driving history. However, State Farm typically offers a discount of around 15% to 25% to eligible drivers, which can add up to significant savings over time. And who doesn’t love saving money, right?

So, what makes a driver eligible for this discount? Essentially, you’ll need to have a clean driving record with no at-fault accidents, moving violations or DUI convictions within the past three years. If you meet these criteria, you could be eligible for the Good Driver Discount and enjoy lower car insurance rates as a result.

In conclusion, if you’re a good driver who wants to save on car insurance, State Farm’s Good Driver Discount could be a great option for you. While the exact savings will depend on your individual circumstances, this discount has the potential to significantly reduce your premiums and help you keep more money in your pocket. So why not contact State Farm today to learn more about this and other car insurance discounts?

State Farm is one of the largest insurance companies in the United States, offering a wide range of insurance products including auto, home, life, and health insurance. One of the many benefits of being a State Farm policyholder is the Good Driver Discount. In this article, we will discuss how much the discount is, how to qualify for it, and other important details about the program.

What is the State Farm Good Driver Discount?

The State Farm Good Driver Discount is a reward program for policyholders who have maintained a clean driving record over a certain period of time. It is designed to encourage safe driving habits and reduce the risk of accidents on the road. The discount can help lower your auto insurance premiums by up to 25% depending on where you live.

How to Qualify for the Good Driver Discount

In order to qualify for the Good Driver Discount, you must meet the following criteria:

- You must have been licensed to drive for at least three years.

- You must not have any at-fault accidents or moving violations within the past three years.

- You must not have been convicted of driving under the influence (DUI) or driving while intoxicated (DWI) within the past five years.

If you meet these requirements, you may be eligible for the Good Driver Discount. Keep in mind that the rules and regulations for the discount may vary by state, so it’s always best to check with your local State Farm agent for more information.

How Much is the Good Driver Discount?

The amount of the Good Driver Discount varies depending on where you live. In some states, the discount can be as high as 25%, while in others it may only be 10%. The average discount is around 15%, but this can vary based on a number of factors, such as your driving record, age, and location.

Other Factors That Affect Your Auto Insurance Premiums

While the Good Driver Discount can help lower your auto insurance premiums, there are other factors that can affect how much you pay:

- Your age, gender, and marital status

- Your credit score

- The make and model of your car

- The amount of coverage you need

- The deductible you choose

It’s important to keep in mind that the discounts and rates for auto insurance can vary greatly from one insurer to another. It’s always a good idea to shop around and compare quotes from multiple companies before making a decision.

How to Apply for the Good Driver Discount

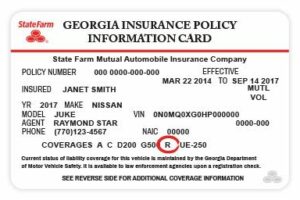

If you believe you qualify for the Good Driver Discount, you can apply by contacting your local State Farm agent or by calling the customer service hotline. You will need to provide proof of your clean driving record, such as a copy of your motor vehicle report (MVR).

Your State Farm agent will be able to give you more information about how much you can save with the Good Driver Discount and answer any questions you may have about the program. They can also help you find other discounts that may apply to your policy, such as the safe driver discount or the multi-car discount.

Conclusion

The State Farm Good Driver Discount is a great way to save money on your auto insurance premiums while promoting safe driving habits. By maintaining a clean driving record and following the rules of the road, you can not only avoid accidents but also earn rewards for your good behavior. If you’re a State Farm policyholder, be sure to ask your agent about the Good Driver Discount and other discounts that may apply to your policy.

With safe driving practices becoming increasingly important, many insurance companies have started to reward their customers for exhibiting good driver behavior. One such company is State Farm, which offers a Good Driver Discount to drivers who maintain a clean driving record. So, how much is State Farm’s Good Driver Discount and how can you qualify for it?

State Farm rewards safe drivers who have exhibited good driving habits over a certain period of time with their Good Driver Discount. To be eligible for this discount, you must meet specific criteria set by the company. Firstly, you must have a clean driving record, meaning no accidents or moving violations within the last three years. Additionally, you must not have any at-fault accidents or major violations on your record.

If you meet these eligibility requirements, you can save money on your car insurance premium with State Farm’s Good Driver Discount. How much you can save depends on various factors such as your age, location, and driving experience. However, on average, drivers can save up to 20% on their car insurance premiums by qualifying for this discount.

A clean driving record is essential to maintaining your Good Driver Discount with State Farm. But what does State Farm consider a clean driving record? A clean driving record includes no accidents or moving violations within the last three years. Minor violations such as speeding tickets or parking tickets may not impact your eligibility for the discount. However, major violations such as DUIs or reckless driving can disqualify you from receiving the discount.

To maintain your Good Driver Discount with State Farm, it’s essential to continue practicing safe driving habits. This includes avoiding distracted driving, following traffic laws, and keeping your eyes on the road at all times. If you do get into an accident, it’s best to report it to State Farm as soon as possible to avoid any negative impacts on your discount eligibility.

If you’re looking to maximize your savings with State Farm, consider combining your discounts. State Farm offers various discounts such as the Drive Safe & Save program, which rewards drivers for driving less and using safe driving habits. By combining these discounts with your Good Driver Discount, you can save even more money on your car insurance premiums.

But what happens if you have an accident on your record? Unfortunately, accidents can happen to anyone, even safe drivers. If you do find yourself in this situation, it’s important to report the accident to State Farm as soon as possible. Depending on the circumstances of the accident, your Good Driver Discount may be impacted. However, if you maintain a clean driving record for at least three years following the accident, you may regain your eligibility for the discount.

If you’re unsure about your Good Driver Discount status with State Farm, you can easily check it by logging into your account on their website or contacting your agent. It’s essential to keep track of your discount eligibility to ensure you’re receiving the maximum savings available to you.

In conclusion, safe driving habits are not only important for your safety but can also help you save money on your car insurance premiums. State Farm rewards safe drivers with their Good Driver Discount, which can save you up to 20% on your premium. To qualify for this discount, you must maintain a clean driving record with no accidents or major violations within the last three years. By continuing to practice safe driving habits and maintaining your eligibility for the discount, you can consistently save money on your car insurance with State Farm.

Once upon a time, there was a driver named John who had been with State Farm for many years. He wondered how much he could save on his car insurance if he qualified for the Good Driver Discount.

John decided to do some research and found out that the discount is available to drivers who have a clean driving record for at least three consecutive years. He also learned that the discount can vary depending on the state where he lives.

Curious about how much he could save, John contacted his State Farm agent who informed him that the discount can range from 5% to 25% off his premium. However, the exact percentage would depend on his driving record, age, and other factors.

Excited about the potential savings, John made sure to maintain his safe driving habits and avoid any traffic violations. After three years of being accident-free, he was delighted to learn that he qualified for the maximum discount of 25%.

Thanks to the State Farm Good Driver Discount, John was able to save hundreds of dollars on his car insurance each year. He felt proud of himself for being a responsible driver and appreciated the recognition and reward from his insurance company.

Point of View

- The State Farm Good Driver Discount is a great incentive for responsible drivers who want to save money on their car insurance.

- It is important to maintain a clean driving record for at least three years in order to qualify for the discount.

- The discount can vary depending on the state where you live and other factors such as age and driving history.

- By taking advantage of the Good Driver Discount, you can save a significant amount of money on your car insurance premiums.

- State Farm values safe driving and rewards its customers who make an effort to be responsible on the road.

Thank you for taking the time to read about State Farm’s Good Driver Discount. We hope that this article has been informative and helpful in understanding the benefits of being a safe driver and how it can save you money on your car insurance rates. As we conclude, let us take a moment to summarize the key takeaways from this piece.

Firstly, being a good driver can significantly impact your car insurance premiums. State Farm recognizes this and offers a discount to individuals who have a clean driving record. This means no at-fault accidents or traffic violations within a specified timeframe. The discount varies depending on your state and policy, but it can be up to 25% off your premium.

Secondly, it is essential to note that State Farm’s Good Driver Discount is not automatic. You need to meet the eligibility criteria and provide proof of your safe driving history to receive the discount. If you are unsure if you qualify for the discount, contact your State Farm agent to discuss your options.

Finally, it is crucial to remember that safe driving is not only beneficial to your wallet but to your safety as well. By following traffic rules and being mindful of others on the road, you can reduce your risk of accidents and injuries. State Farm’s Good Driver Discount serves as an incentive to promote safe driving habits and reward those who practice them.

In conclusion, State Farm’s Good Driver Discount is an excellent opportunity for drivers to save on their car insurance premiums while promoting safe driving habits. If you meet the eligibility criteria, we encourage you to take advantage of this discount and enjoy the benefits of being a safe driver. Thank you for reading, and we wish you safe travels on the road ahead.

.

People also ask about How Much Is State Farm Good Driver Discount:

- What is the State Farm Good Driver Discount?

- How much can I save with the State Farm Good Driver Discount?

- Is the State Farm Good Driver Discount available in all states?

- Do I need to enroll in the State Farm Good Driver Discount program?

- What other discounts does State Farm offer?

The State Farm Good Driver Discount is a program that rewards policyholders for maintaining a clean driving record. If you have not been in an accident or received any traffic violations in the past three years, you may qualify for this discount.

The amount you can save with the State Farm Good Driver Discount varies depending on your location and driving history. However, most policyholders can expect to save between 5% and 15% on their auto insurance premiums.

The State Farm Good Driver Discount is available in most states where State Farm offers auto insurance. However, the exact discount amount and eligibility requirements may vary by state.

No, you do not need to enroll in the State Farm Good Driver Discount program. If you qualify for the discount, it will be automatically applied to your policy when you renew your coverage.

In addition to the Good Driver Discount, State Farm offers a variety of other discounts for its policyholders. These include discounts for good students, multiple vehicles, bundling policies, and more.

Overall, the State Farm Good Driver Discount is a great way to save money on your auto insurance premiums if you have a clean driving record. To see if you qualify for this discount, contact your local State Farm agent today.