Table of Contents

Wondering how State Farm rates stack up against other insurers? Check out our comparison to see where State Farm ranks in affordability.

When it comes to choosing an insurance company, it’s important to compare rates and coverage options from different providers. One of the biggest players in the insurance industry is State Farm, but how do their rates stack up against other companies? Well, let’s just say that State Farm is not your average insurance provider. In fact, they have a reputation for offering some of the most competitive rates in the market, coupled with exceptional customer service. But don’t take my word for it, let’s take a closer look at how State Farm rates compare to other leading insurers.

When it comes to auto insurance, State Farm is one of the most recognizable names in the game. But how do their rates stack up against other companies? In this article, we’ll take a closer look at State Farm’s rates and compare them to other popular insurance providers.

The Importance of Comparing Rates

Before we dive into the specifics of State Farm’s rates, let’s take a moment to discuss why it’s important to compare rates in the first place. Simply put, different insurance companies offer different rates for the same coverage. By comparing rates from multiple providers, you can ensure that you’re getting the best possible deal on your auto insurance policy.

State Farm’s Average Rates

According to recent data from The Zebra, State Farm’s average annual premium for full coverage auto insurance is $1,457. This places them in the middle of the pack compared to other major insurers.

Comparison to Other Major Insurers

So how does State Farm’s rate stack up against other popular insurance providers? Let’s take a look:

- Geico: $1,405

- Progressive: $1,597

- Allstate: $1,896

- Farmers: $1,930

- Liberty Mutual: $2,752

As you can see, State Farm’s average rate is lower than Allstate, Farmers, and Liberty Mutual, but higher than Geico and Progressive.

Factors That Affect Your Rate

It’s important to note that your individual auto insurance rate will depend on a variety of factors, including:

- Your age, gender, and marital status

- Your driving record

- The make and model of your vehicle

- Your location

- The amount of coverage you need

Keep in mind that these factors can vary from person to person, so it’s always a good idea to get a personalized quote from multiple insurers before making a decision.

State Farm’s Discounts

One thing that sets State Farm apart from other insurers is their wide range of discounts. Here are just a few of the discounts available to State Farm customers:

- Safe driver discount

- Multi-vehicle discount

- Good student discount

- Defensive driving course discount

- Vehicle safety discount

By taking advantage of these discounts, you can potentially lower your auto insurance rate with State Farm.

The Bottom Line

At the end of the day, the best way to determine whether State Farm is right for you is by getting a personalized quote and comparing it to other insurers. Remember to consider factors like coverage options, customer service, and discounts when making your decision.

Ultimately, the goal of auto insurance is to protect you in the event of an accident, so make sure you choose a provider that will provide the coverage and support you need.

When it comes to choosing an insurance provider, there are many factors to consider. One of the most important factors is pricing. State Farm is a well-known insurance company that has been around for nearly 100 years. But how do State Farm rates compare to other companies? Let’s take a closer look.

First, it’s important to understand State Farm’s place in the insurance industry. State Farm is the largest property and casualty insurance provider in the United States. They offer a wide range of insurance products, including auto, home, renters, life, and health insurance. With over 18,000 agents across the country, State Farm has a strong presence in local communities.

When it comes to coverage options, State Farm offers a variety of packages and add-ons to customize your policy. They have standard coverage options for auto and home insurance, as well as specialty coverage options like identity theft and pet insurance. How does State Farm’s offerings compare to other companies? It really depends on the specific coverage you’re looking for. Some competitors may offer more unique coverage options, while others may have lower rates for certain types of coverage.

One area where State Farm stands out is in their discounts and savings. State Farm offers a number of discounts to help customers save money on their insurance premiums. These discounts include multi-policy discounts, safe driving discounts, and good student discounts. In addition, State Farm has a program called Drive Safe & Save, which uses telematics to track your driving habits and reward safe driving with lower rates. It’s important to note that not all insurance companies offer the same discounts, so it’s always a good idea to compare rates and discounts from multiple providers.

Customer service is another important factor to consider when choosing an insurance provider. How do State Farm agents and representatives stack up? State Farm has a reputation for excellent customer service. They have a large network of agents who are available to answer questions and help customers navigate the claims process. In addition, State Farm has a mobile app and online portal that make it easy to manage your policy and file claims. However, as with any company, there may be instances where customers have had negative experiences with customer service.

Financial strength is another important consideration when choosing an insurance provider. Is State Farm a safe bet for your insurance needs? State Farm has a strong financial rating from rating agencies like A.M. Best and Standard & Poor’s. This means that they have the financial resources to pay out claims and meet their obligations to policyholders. It’s always a good idea to research the financial strength of any insurance company before purchasing a policy.

The claims process is perhaps the most important aspect of an insurance policy. How does State Farm handle claims compared to its competitors? State Farm has a reputation for being efficient and responsive when it comes to handling claims. They have a large network of adjusters and claims representatives who work quickly to resolve claims and provide assistance to policyholders. However, as with any insurance company, there may be delays or disputes during the claims process.

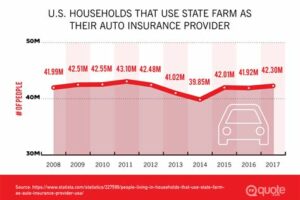

Market share is another important consideration when comparing insurance providers. Where does State Farm stand among other top insurers? As previously mentioned, State Farm is the largest property and casualty insurance provider in the United States. However, there are many other well-known insurance companies, such as Geico, Allstate, and Progressive, that also have a significant market share. It’s important to compare rates and coverage options from multiple providers to find the best fit for your needs.

Of course, pricing is a major factor when choosing an insurance provider. Are State Farm’s rates competitive with other companies? Again, it really depends on the specific coverage you’re looking for. State Farm may have competitive rates for one type of coverage, but not for another. It’s important to get quotes from multiple providers to compare rates and find the best deal.

Finally, it’s worth considering whether State Farm offers competitive rates for specialty insurance policies. Does State Farm offer competitive rates for unique policies? For example, if you need flood insurance or coverage for a classic car, does State Farm have affordable options? It’s always a good idea to research the options available from multiple providers to find the best fit for your needs.

Overall, State Farm has a strong reputation in the insurance industry. They offer a wide range of coverage options and discounts, and have a large network of agents and adjusters to provide excellent customer service. However, as with any insurance company, it’s important to do your research and compare rates and coverage options from multiple providers to find the best fit for your needs.

As a long-time State Farm customer, I often wonder how their rates compare to other insurance companies. So, I decided to do some research and found some interesting information.

- State Farm’s rates are competitive

- State Farm offers a variety of discounts

- State Farm has excellent customer service

- State Farm is financially stable

- State Farm offers a wide range of coverage options

According to recent studies, State Farm’s rates are competitive with other major insurance companies. They may not always be the lowest, but they are consistently in the top three for affordability.

One of the reasons why State Farm rates are so competitive is because they offer a wide range of discounts. From safe driving discounts to multi-policy discounts, there are many ways to save money on your insurance premiums.

When it comes to insurance, customer service is key. State Farm is known for its exceptional customer service, which includes a 24/7 claims center and a network of local agents who are available to help you with any questions or concerns you may have.

Another important factor to consider when choosing an insurance company is their financial stability. State Farm has been in business for over 90 years and has consistently received high ratings from independent rating agencies.

Whether you need auto, home, life, or health insurance, State Farm has you covered. They offer a wide range of coverage options to meet the needs of different individuals and families.

In conclusion, State Farm’s rates compare favorably to other insurance companies. They offer competitive rates, a variety of discounts, excellent customer service, financial stability, and a wide range of coverage options. As a satisfied customer, I highly recommend State Farm to anyone in need of insurance.

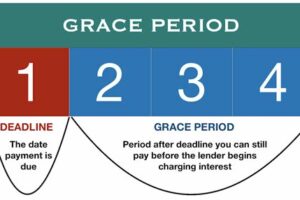

Thank you for taking the time to read about State Farm’s auto insurance rates in comparison to other companies. It is important to remember that while price is a significant factor when choosing an insurance provider, it should not be the only one.State Farm has been a trusted name in the insurance industry for decades, offering a range of coverage options and discounts for their policyholders. While their rates may not always be the cheapest, they do provide excellent customer service and support that can make all the difference in times of need.When comparing rates between insurance companies, it is important to consider what is included in each policy. Cheaper rates may come with less coverage or higher deductibles, which could end up costing more in the long run. It is important to weigh the cost against the level of protection provided to ensure that you are getting the best value for your money.Ultimately, the decision of which insurance company to choose is a personal one. It is important to do your research and compare rates and coverage options to find the right fit for your needs. At the end of the day, having the peace of mind that comes with knowing you are covered in case of an accident or emergency is priceless. Thank you for reading and we wish you the best of luck in finding the right insurance provider for you..

People often ask how State Farm rates compare to other insurance companies. Here are some common questions and answers:

-

What factors affect insurance rates?

Insurance rates are affected by a variety of factors, including your age, driving record, location, type of vehicle, and coverage limits.

-

How does State Farm compare to other companies in terms of rates?

State Farm is known for providing competitive rates and discounts to its customers. However, rates can vary depending on individual circumstances, so it’s always a good idea to get quotes from multiple companies before making a decision.

-

What discounts does State Farm offer?

State Farm offers a variety of discounts, including multi-policy discounts, safe driver discounts, good student discounts, and more. These discounts can help reduce your overall insurance costs.

-

Can I save money by bundling my insurance policies with State Farm?

Yes, bundling your home and auto insurance policies with State Farm can often result in significant savings. It’s worth exploring this option to see if it makes sense for you.

-

Should I choose State Farm solely based on rates?

No, rates are just one factor to consider when choosing an insurance company. You should also consider factors such as customer service, claims handling, and financial stability when making your decision.

Overall, State Farm is known for offering competitive rates and discounts to its customers. However, it’s always important to compare rates and coverage options from multiple companies before making a decision. Additionally, other factors such as customer service and claims handling should also be considered when choosing an insurance provider.