Table of Contents

Are you considering getting a trampoline and wondering if State Farm allows it? Read on to find out what their policy is on trampolines.

Are you considering adding a trampoline to your backyard for your kids to enjoy? If you’re a State Farm policyholder, you may be wondering if your insurance will cover any accidents or injuries that may occur while using a trampoline. With the rising popularity of trampolines, it’s important to know the guidelines and policies of your insurance provider. So, does State Farm allow trampolines? The answer is not as straightforward as you may think. Let’s dive into the details and find out what you need to know before bouncing into a trampoline purchase.

Trampolines have become increasingly popular in recent years, providing endless hours of fun and entertainment for families and children alike. However, with this rise in popularity comes a growing concern for safety and liability. As a result, many homeowners insurance companies have started to restrict or even prohibit trampolines on their policies. This article will explore whether State Farm allows trampolines and what you need to know before you jump in.

The Dangers of Trampolines

Trampolines can be a lot of fun, but they can also be incredibly dangerous. According to the Consumer Product Safety Commission (CPSC), there were an estimated 108,000 trampoline-related injuries treated in emergency rooms in 2019 alone. The most common injuries are fractures, sprains, and bruises, but more serious injuries such as head and spinal cord injuries can also occur.

State Farm’s Policy on Trampolines

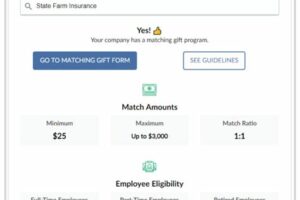

State Farm is one of the largest homeowners insurance providers in the United States. While they do not explicitly prohibit trampolines, they do have certain guidelines and requirements that must be met in order for a trampoline to be covered under their policy. Firstly, the trampoline must have safety features such as a safety net, padding, and a secure enclosure. Secondly, it must be in good condition and well-maintained. Lastly, it must be located in a safe area away from structures such as trees or power lines. If the trampoline meets these requirements, State Farm may cover it under their policy. However, it’s important to note that coverage may vary depending on the state you live in and the specific policy you have with State Farm.

Additional Liability Coverage

Even if your trampoline meets State Farm’s requirements, it’s still important to consider additional liability coverage. Trampolines can be incredibly risky, and accidents can happen even with all the necessary safety precautions in place. Adding an umbrella liability policy to your homeowners insurance can provide extra protection in case of a trampoline-related injury. This type of policy offers additional coverage above and beyond your standard homeowners policy and can protect you from lawsuits and other legal expenses.

Alternatives to Trampolines

If you’re concerned about the risks associated with trampolines, there are alternatives that can provide similar levels of fun and entertainment. Some popular options include inflatable bounce houses, swing sets, and playsets.

Taking Safety Precautions

If you do decide to purchase a trampoline, it’s important to take proper safety precautions to prevent injuries. These include: – Only one person should be on the trampoline at a time – Do not allow children under the age of six to use the trampoline – Always supervise children while they’re using the trampoline – Install safety features such as a safety net and padding – Regularly inspect the trampoline for wear and tear

Conclusion

In conclusion, State Farm does allow trampolines as long as certain requirements are met, such as safety features and proper maintenance. However, it’s important to consider additional liability coverage and alternative options if you’re concerned about the risks associated with trampolines. Always take proper safety precautions to prevent injuries and ensure that your trampoline is in good condition.

Taking the Leap: Can You Have a Trampoline with State Farm Insurance? Many families are drawn to the idea of owning a trampoline, providing hours of outdoor fun and exercise for kids and adults alike. But before investing in one, it’s important to understand how your insurance company views this high-risk activity. As one of the largest providers of homeowner’s insurance in the country, State Farm has a policy in place regarding trampolines on your property.

Jumping for Joy: The Pros and Cons of Owning a Trampoline with State Farm. On the one hand, trampolines can offer a variety of benefits, including increased physical activity and entertainment for the whole family. However, they also come with risks, such as potential injuries and liability issues. Before deciding whether to purchase a trampoline, it’s important to weigh these pros and cons and determine if the benefits outweigh the potential risks.

Bouncing Back: Understanding State Farm’s Trampoline Policy. State Farm’s policy regarding trampolines is relatively straightforward. They will provide coverage for trampolines, but only if certain safety guidelines are followed. If these guidelines are not met, State Farm may deny coverage or add an exclusion to your policy.

Up in the Air: How State Farm Views Trampolines in Your Home. State Farm views trampolines as a high-risk activity due to the potential for injuries and liability concerns. As a result, they require homeowners to take specific safety precautions to minimize these risks.

Springing into Action: State Farm’s Safety Guidelines for Trampolines. State Farm requires homeowners to take several safety precautions when owning a trampoline, including installing safety nets, securing the trampoline to the ground, and placing it in a safe location away from trees and other hazards. Additionally, State Farm strongly recommends that trampolines are only used under adult supervision.

A High-Risk Activity: Why State Farm May Limit Trampoline Coverage. Due to the inherent risks associated with trampolines, State Farm may limit coverage or add an exclusion to your policy if you own one. This is to protect both you and State Farm from potential liability issues that could arise from a trampoline-related accident.

The Fine Print: What State Farm’s Trampoline Exclusion Means for You. If State Farm adds a trampoline exclusion to your policy, it means that they will not provide coverage for any injuries or damages related to your trampoline. This means that if someone is injured on your trampoline, you may be personally liable for any resulting medical bills or legal fees.

A Flexible Solution: Finding Alternatives to Trampolines with State Farm. If you’re concerned about the risks associated with owning a trampoline, there are several alternatives that can provide similar benefits without the same level of danger. Consider investing in a bounce house or inflatable water slide instead, which can be just as entertaining and safe for the whole family.

Airborne Liability: How State Farm Handles Trampoline Accidents. In the event that someone is injured on your trampoline, State Farm will investigate the incident to determine if any negligence or unsafe behavior contributed to the accident. If they find that you were at fault, they may deny coverage and you may be held personally liable for any resulting damages.

Making an Informed Decision: Weighing the Risks and Rewards of Trampoline Ownership with State Farm. Ultimately, the decision to own a trampoline with State Farm insurance comes down to how much risk you’re willing to take on. If you’re willing to follow the safety guidelines and take precautions to minimize the risks, owning a trampoline can be a fun and rewarding experience. However, if you’re not comfortable with the potential liability issues, it may be best to explore other options for outdoor entertainment.

Once upon a time, there was a family who loved to spend time outdoors. They enjoyed playing games, having picnics, and bouncing on their trampoline. However, they were concerned about their insurance coverage and wondered, Does State Farm allow trampolines?

- Point of View: State Farm is a responsible insurance company that prioritizes the safety of its clients.

- State Farm understands that trampolines can be fun, but they also pose a significant risk of injury.

- For this reason, State Farm has specific guidelines when it comes to trampolines.

- If you have a trampoline on your property, you must inform your State Farm agent.

- You may also be required to install safety features, such as a net enclosure or padding around the edges.

- In some cases, State Farm may require you to remove the trampoline altogether.

- While this may seem strict, it is ultimately for your own protection.

- If someone is injured on your trampoline, you could be held liable for their medical bills and other expenses.

- By following State Farm’s guidelines, you can ensure that you are covered in the event of an accident.

- So, if you’re wondering, Does State Farm allow trampolines? the answer is yes, but with certain conditions.

In conclusion, State Farm understands that trampolines can be a fun addition to any backyard, but they also come with inherent risks. By following State Farm’s guidelines, you can enjoy your trampoline while also protecting yourself and your family. Remember, safety should always come first!

Thank you for taking the time to read this blog post about whether State Farm allows trampolines on their insurance policies. We hope that we have provided you with valuable information and insights into the matter at hand.

As we have discovered, State Farm does allow trampolines on their insurance policies but with certain conditions and restrictions. It is important to note that these restrictions are in place to ensure the safety of the individuals using the trampoline and to minimize the risk of accidents or injuries.

So, if you are considering adding a trampoline to your backyard, be sure to reach out to your State Farm agent to discuss the specific guidelines and requirements that must be met. This will not only keep you in compliance with your insurance policy but also give you peace of mind knowing that you and your loved ones are protected.

In conclusion, having a trampoline can be a fun addition to any backyard, but it is essential to follow the rules and regulations set forth by your insurance provider. We hope that this blog post has been informative and helpful to you. Thank you for visiting our site, and we look forward to sharing more valuable content with you in the future!

.

People also ask about whether State Farm allows trampolines on their property. Here are some of the most common questions:

- Does State Farm allow trampolines?

- What are the conditions for having a trampoline on my property?

- Do I need to notify State Farm if I have a trampoline?

- What happens if someone gets injured on my trampoline?

- Can I get coverage for my trampoline under my homeowner’s insurance policy?

Yes, State Farm does allow trampolines but with certain conditions.

You must have a safety enclosure around the trampoline to prevent injuries. You may also be required to have liability insurance in case someone gets hurt while using the trampoline.

Yes, you should inform State Farm if you have a trampoline on your property. This is important because it could affect your homeowner’s insurance policy and coverage.

If someone gets hurt while using your trampoline, you could be held liable for their injuries. Having liability insurance can help protect you financially in case of a lawsuit.

Yes, you can typically add coverage for your trampoline to your homeowner’s insurance policy. However, this will vary depending on your specific policy and insurance provider.

Overall, while State Farm does allow trampolines on their property, it’s important to take necessary safety precautions and consider adding liability insurance coverage to protect yourself financially in case of accidents or injuries.