Table of Contents

Want to cancel your State Farm policy? Learn how to do it hassle-free with our step-by-step guide. Say goodbye to insurance you no longer need!

Are you tired of paying high premiums for your State Farm policy? Or have you found a better insurance provider that suits your needs? Whatever your reason may be, canceling your State Farm policy can be a daunting task. But don’t worry, we’ve got you covered!

Firstly, it’s important to note that canceling your policy mid-term may result in penalties or fees. So, it’s essential to read the terms and conditions of your policy to understand the cancellation process and any associated costs.

If you’ve decided to go ahead with canceling your policy, the first step is to contact your State Farm agent. They will guide you through the process and provide you with the necessary forms to fill out.

Next, you need to inform your new insurance provider of your intent to cancel your State Farm policy. This ensures that you don’t end up without insurance coverage while switching providers.

Lastly, make sure to follow up with State Farm to confirm that your policy has been canceled and that there are no outstanding balances owed.

Cancelling your State Farm policy might seem like a hassle, but with the right guidance, it can be a smooth transition to a new insurance provider that better meets your insurance needs.

Are you looking to cancel your State Farm policy? Perhaps you’ve found a better deal or maybe you’re just no longer in need of their services. Whatever the reason may be, cancelling your State Farm policy can seem like a daunting task. However, with a little bit of patience and understanding, cancelling your policy can be a fairly simple process.

Gather Your Information

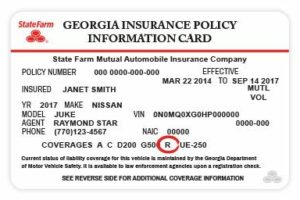

The first step in cancelling your State Farm policy is to gather all of the necessary information. This includes your policy number, the date you want to cancel your policy, and your reason for cancelling. It’s also a good idea to have any relevant documentation, such as your insurance card or billing statements, on hand.

Contact State Farm

Once you have all of your information, it’s time to contact State Farm. You can do this by calling their customer service department or by visiting your local State Farm agent. Be prepared to provide them with your policy number and your reason for cancelling.

Provide Reason for Cancellation

When contacting State Farm, it’s important to provide them with a reason for cancelling your policy. This can include anything from finding a better deal elsewhere to simply no longer needing their services. Providing a reason can help State Farm improve their services and may even lead to a better deal if you decide to stay with them in the future.

Review Cancellation Policies

Before cancelling your policy, it’s important to review State Farm’s cancellation policies. This includes any fees or penalties that may apply, as well as any potential impact on your credit score. It’s also a good idea to review any other policies you may have with State Farm, such as home or renters insurance, to ensure that cancelling your policy won’t have any unintended consequences.

Ask About Refunds

If you’ve paid for your policy in advance, it’s important to ask about any potential refunds. State Farm may offer a prorated refund for any unused portion of your policy, but it’s important to ask about this upfront to avoid any surprises.

Submit Cancellation Request in Writing

Once you’ve spoken with State Farm and reviewed their policies, it’s time to submit your cancellation request in writing. This can be done through email or by sending a letter to State Farm’s corporate office. Be sure to include your policy number, the date you want to cancel, and your reason for cancelling.

Confirm Cancellation

After submitting your cancellation request, it’s important to confirm that your policy has been cancelled. You can do this by checking your account online or by contacting State Farm directly. It’s also a good idea to confirm any refunds or credits that may apply.

Consider Your Options

Cancelling your State Farm policy is a big decision, so it’s important to consider your options carefully. If you’re cancelling because of the cost, consider reaching out to a State Farm agent to see if there are any discounts or other ways to lower your premium. You may also want to consider shopping around and comparing quotes from other insurance providers.

Notify Other Parties

If you have any other parties listed on your policy, such as a spouse or co-owner, it’s important to notify them of your cancellation. This can help prevent any confusion or issues down the line.

Stay Organized

Cancelling your State Farm policy can be a complex process, so it’s important to stay organized throughout. Keep all of your documentation in one place and make note of any important dates or deadlines. This can help ensure that the process goes smoothly and that you don’t miss any important steps.

Cancelling your State Farm policy doesn’t have to be a stressful experience. By following these simple steps and staying organized, you can cancel your policy with ease and move on to whatever comes next.

Knowing when to cancel a State Farm policy can save you money and prevent unnecessary expenses. If you feel like your current coverage is not meeting your needs or if you have found a better deal elsewhere, it may be time to review your policy and consider cancellation.

The first step in canceling your State Farm policy is reviewing the terms and conditions of your policy. Take the time to read through all of the details and make sure that you fully understand the implications of canceling your coverage. Consider whether you are currently facing any issues with your policy, such as high premiums or inadequate coverage, that may be resolved by speaking to your agent.

Contacting your State Farm agent is the next step in canceling your policy. Your agent can provide guidance on the best way to cancel your policy and any additional information you may need to know. They can also help you determine whether you are eligible for any refunds or discounts that may be available to you.

Once you have spoken to your agent, request a cancellation form. This form will outline the steps you need to take to cancel your policy and provide you with the necessary information to do so. Be sure to fill out the form completely and accurately to ensure that your cancellation is processed correctly.

When requesting a cancellation form, be prepared to provide a reason for cancellation. This may include finding a better deal with a different insurance provider, moving to a new location, or simply no longer needing coverage. Providing a clear and concise reason for cancellation can help expedite the process and ensure that your request is processed in a timely manner.

Checking for refund eligibility is an important step in canceling your State Farm policy. Depending on your policy and the amount of time remaining before it expires, you may be eligible for a partial refund. Be sure to review your policy and speak with your agent to determine whether you are eligible for a refund and, if so, how much you can expect to receive.

Confirming cancellation details is essential to ensure that your policy is canceled properly. Make sure that you have received confirmation of your cancellation from State Farm and that you understand the terms of your cancellation. This may include any fees or penalties associated with canceling your policy before it expires.

Returning insurance documents is another important step in canceling your State Farm policy. Be sure to return all of your insurance documents to State Farm, including your policy and any related paperwork. This can help prevent any confusion or misunderstandings regarding your policy cancellation in the future.

If you are enrolled in automatic payments, discontinuing them is crucial to prevent any further charges from being made to your account. Be sure to notify State Farm of your intent to discontinue automatic payments and take any necessary steps to ensure that your account is not charged for any additional premiums.

Finally, seeking alternative insurance options is an important step to take after canceling your State Farm policy. Be sure to research other providers and compare their rates and coverage options before making a decision. This can help you find the best deal possible and ensure that your insurance needs are met.

In conclusion, canceling your State Farm policy can be a simple and straightforward process if you follow these steps. By reviewing your policy, contacting your agent, completing the necessary paperwork, and taking the appropriate steps to discontinue your automatic payments, you can ensure that your policy is canceled properly and that you are not charged any unnecessary fees or penalties. By seeking alternative insurance options, you can also find a new provider that meets your needs and budget.

Are you thinking about canceling your State Farm policy? Perhaps you’ve found a better deal elsewhere, or maybe you’re just ready to move on. Whatever the reason, canceling your policy is a straightforward process that can be completed quickly and easily. Here is a step-by-step guide on how to cancel your State Farm policy:

- Call your State Farm agent: The first step in canceling your policy is to call your State Farm agent. They will be able to guide you through the process and answer any questions you may have. Be sure to have your policy number handy when you call.

- Provide your reason for canceling: Your State Farm agent will ask you why you want to cancel your policy. This information helps them understand why you’re leaving and may help them make changes to their policies in the future.

- Verify your identity: To cancel your policy, you’ll need to verify your identity. Your State Farm agent will likely ask you for personal information, such as your name, address, and date of birth. They may also ask for your social security number or driver’s license number.

- Confirm your cancellation date: Once your identity has been verified, your State Farm agent will ask you to confirm the date you would like your policy to be canceled. Depending on your policy, you may be entitled to a refund for any unused premium.

- Ask for confirmation: Before hanging up the phone, be sure to ask your State Farm agent for confirmation of your cancellation. They should provide you with a confirmation number or email you a confirmation letter. Keep this information in a safe place in case you need it in the future.

Cancelling your State Farm policy may seem daunting, but it is a simple process that can be completed in just a few minutes. By following these steps, you can ensure that your policy is canceled correctly and that you are not left paying for coverage that you no longer need. Good luck!

Thank you for taking the time to read through our guide on how to cancel your State Farm policy. We understand that this process can be overwhelming and confusing, but we hope that our step-by-step instructions have made it easier for you.We want to remind you that cancelling your policy should not be taken lightly, as it can have consequences such as losing coverage or paying penalties. It’s important to weigh all your options and consider your current situation before making a decision.If you have any further questions or concerns about cancelling your State Farm policy, we encourage you to reach out to their customer service representatives. They will be able to provide you with personalized guidance that can help you make an informed decision.In conclusion, we want to stress the importance of being proactive when it comes to managing your insurance policies. Regularly reviewing and updating your coverage can help you save money, avoid headaches, and ensure that you’re always protected in case of unexpected events.Thank you again for visiting our blog, and we hope that you found our guide helpful. Don’t hesitate to leave a comment or contact us if you have any feedback or suggestions for future topics!.

When it comes to canceling your State Farm policy, there may be a few questions that come to mind. Here are some of the most common people also ask inquiries along with their corresponding answers:

1. How do I cancel my State Farm policy?

To cancel your State Farm policy, you will need to contact your local agent directly. You can find their contact information on the State Farm website or mobile app. Alternatively, you can call the State Farm customer service line at 1-800-STATE-FARM (1-800-782-8332) and they can assist you in finding your local agent.

2. Is there a cancellation fee?

State Farm does not charge a cancellation fee for terminating your policy early. However, if you have made any payments in advance, you may be entitled to a refund for any unused premiums.

3. What happens to my unused premium?

If you have paid your premiums in advance and decide to cancel your policy early, you may be entitled to a refund for any unused premium. The amount of the refund will depend on how much time is left on your policy. Your local State Farm agent can provide more information on how to receive your refund.

4. Can I cancel my policy at any time?

Yes, you can cancel your State Farm policy at any time. However, it’s important to remember that canceling your policy early may result in penalties such as higher rates or difficulty obtaining coverage in the future.

5. Do I need to provide a reason for canceling my policy?

No, you do not need to provide a reason for canceling your State Farm policy. However, your local agent may ask for feedback on your experience to help improve their service.

By understanding the process of canceling a State Farm policy and the potential consequences, you can make an informed decision about whether or not it’s the right choice for you.