Table of Contents

Wondering if Allstate or State Farm is the better choice for insurance? Find out which one comes out on top in this comprehensive comparison.

When it comes to choosing an insurance provider, two names that often come up are Allstate and State Farm. But the question remains: which one is better? While both companies offer a range of policies and services, there are some key differences that set them apart. For instance, Allstate boasts a strong reputation for customer service and a wide variety of discounts, while State Farm is known for its extensive network of agents and personalized approach to coverage.

However, it’s important to keep in mind that what works for one person may not work for another. Factors such as location, driving record, and budget can all play a role in determining which insurance provider is the right fit. That said, taking the time to compare and contrast the offerings of Allstate and State Farm can help you make an informed decision about your insurance needs. So, without further ado, let’s dive into the details and see how these two industry giants stack up against each other.

When it comes to choosing insurance for your car, home, or life, there are two big names that come to mind: Allstate and State Farm. Both companies have been around for over 80 years and have built a reputation of trust and reliability in the industry.

But when it comes down to choosing one over the other, many people wonder: is Allstate better than State Farm? In this article, we’ll take a closer look at both companies and compare their strengths and weaknesses to help you make an informed decision.

Allstate vs. State Farm: Overview

Both Allstate and State Farm offer a wide range of insurance products, including auto, home, renters, and life insurance. However, State Farm also offers additional products such as health insurance, small business insurance, and banking and investment services.

When it comes to customer service, both companies are highly rated. Allstate has received an A+ rating from the Better Business Bureau, while State Farm has received an A rating. Both companies also have mobile apps and online portals to make managing your policy and filing claims easier and more convenient.

Pricing and Discounts

When comparing Allstate and State Farm, pricing is one of the most important factors to consider. While both companies offer competitive rates, your premium will depend on several factors such as your age, driving history, and location.

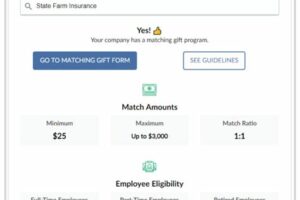

Allstate offers a variety of discounts, including safe driver discounts, multiple-policy discounts, and early signing discounts. State Farm also offers similar discounts, but they also have programs such as Drive Safe & Save and Steer Clear that can help you save even more money on your premium.

Claims Process

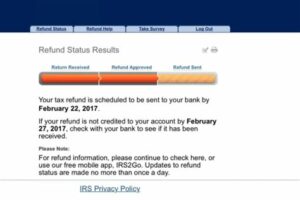

When it comes to filing a claim, both Allstate and State Farm have a simple and straightforward process. You can file a claim online, through their mobile app, or by calling their customer service hotline.

Allstate has a satisfaction guarantee, which means if you’re not happy with the way your claim was handled, they will work with you to make it right. State Farm also has a satisfaction guarantee and offers 24/7 claims support.

Financial Strength and Ratings

Another important factor to consider when choosing an insurance company is their financial strength and ratings. Both Allstate and State Farm are financially stable and have strong ratings from independent rating agencies such as A.M. Best and Moody’s.

Allstate has an A+ rating from A.M. Best and an A- rating from Moody’s. State Farm has an A++ rating from A.M. Best and an Aa1 rating from Moody’s. These ratings indicate that both companies are financially sound and have the ability to pay out claims.

The Bottom Line

So, is Allstate better than State Farm? The answer really depends on your individual needs and preferences. Both companies offer reliable service, competitive rates, and a variety of discounts and products.

If you’re looking for a company that offers a wide range of insurance and financial products, State Farm may be the better choice. However, if you value customer service and want a company with a satisfaction guarantee, Allstate may be the better option.

Ultimately, it’s important to do your own research and compare quotes from both companies to make an informed decision. By taking the time to compare rates, discounts, and coverage options, you can find the right insurance policy that meets your needs and fits within your budget.

When it comes to insurance, Allstate and State Farm are two titans battling it out for supremacy. With millions of satisfied customers across the country, both companies offer a wide range of insurance products. So, which of these giants is better? Let’s compare them on key factors.

Firstly, financial strength is essential in choosing an insurer. Both Allstate and State Farm have excellent financial ratings, indicating that they have the resources to cover any claims. Allstate has an A+ rating from A.M. Best, while State Farm boasts an A++.

Secondly, if you’re looking for auto insurance, both Allstate and State Farm have extensive coverage options. Allstate’s Drivewise program rewards good driving habits. Meanwhile, State Farm’s telematics program, Drive Safe & Save, can help lower premiums. State Farm’s Pocket Agent app also makes it easy to manage policies on the go.

Your home is likely your biggest investment, so it’s important to have adequate coverage. Allstate offers comprehensive homeowners insurance options, including flood and personal property coverage, while State Farm provides liability coverage, natural disaster protection, and identity theft coverage through its Good Neighbor policy.

Both Allstate and State Farm offer life insurance policies for those looking to protect their loved ones in the event of an untimely death. Allstate offers term life insurance policies, while State Farm offers both term and whole life insurance options.

Customer satisfaction is key, and both Allstate and State Farm have won numerous awards. Allstate recently received an award for being the Best Overall Auto Insurance Company by The Balance, while State Farm consistently receives high marks from J.D. Power and Associates Insurance Satisfaction Study.

In today’s digital age, online tools are essential. Allstate’s website and mobile app offer easy access to policy documents and claims forms, while State Farm’s mobile app allows policyholders to submit claims, access ID cards, and make policy changes.

Both Allstate and State Farm offer a range of discounts and savings options, such as multi-policy discounts and good driving discounts. However, eligibility requirements and rules for these discounts may vary between the two companies.

Finally, availability is important. Both Allstate and State Farm have thousands of agents and branch offices across the country. Allstate primarily sells policies through agents, while State Farm offers online quotes and policy purchases.

In conclusion, there’s no clear winner between Allstate and State Farm. Both are reputable companies with excellent financial strength, customer satisfaction ratings, and coverage options. It largely depends on your unique insurance needs and preferences.

Once upon a time, there was a man named John who wanted to find the best insurance company for his car. He did some research and found that Allstate and State Farm were two of the most popular choices. But which one was better?

Is Allstate Better Than State Farm?

- Allstate offers more discounts than State Farm, including safe driver discounts, anti-theft discounts, and multiple policy discounts. This can result in lower monthly premiums for customers.

- Allstate has a better mobile app than State Farm, with features like accident forgiveness and roadside assistance built-in. This makes it easier for customers to manage their policies and file claims on-the-go.

- State Farm has more agents and locations nationwide than Allstate, which can be beneficial for customers who prefer to work with a local agent or need in-person assistance.

- Allstate has a higher customer satisfaction rating than State Farm, according to J.D. Power’s annual insurance survey. Customers reported being more satisfied with Allstate’s claims process and customer service.

In the end, John decided to go with Allstate for his car insurance. He liked the variety of discounts available and felt more confident in their customer service. However, everyone’s insurance needs are different, so it’s important to do your own research and compare quotes from multiple companies before making a decision.

Overall, it can be said that Allstate is better than State Farm in terms of discounts, mobile app, and customer satisfaction, but State Farm may have an advantage in terms of agent availability and personalized service. Ultimately, the choice between the two will depend on what is most important to the individual customer.

Dear valued readers, I hope this article has been informative and helpful in your quest to find the perfect insurance company. As we come to a close, it’s important to remember that both Allstate and State Farm have their strengths and weaknesses. Ultimately, the decision on which company is better depends on your personal preferences and needs.

Allstate offers a wide range of insurance products and services, including auto, home, and life insurance. They are known for their excellent customer service and innovative technology such as their Drivewise program. However, they may not be the most affordable option for everyone and their discounts may not be as extensive as other companies.

On the other hand, State Farm is a well-established company with a strong financial backing. They offer competitive rates and discounts, making them an attractive choice for those on a tight budget. They also have a large network of agents and a user-friendly website. However, some customers have reported issues with their claims process and customer service.

In conclusion, whether you choose Allstate or State Farm, it’s important to do your research and compare quotes from multiple companies before making a decision. Consider factors such as coverage options, discounts, customer service, and financial strength. Remember, the right insurance company for you is the one that meets your unique needs and provides you with peace of mind.

Thank you for reading our article and we wish you the best of luck in finding the perfect insurance company for you!

.

People also ask: Is Allstate Better Than State Farm?

When it comes to choosing between two of the largest insurance companies in the United States, it’s important to weigh the pros and cons of each. Here are some common questions people ask about whether Allstate is better than State Farm:

- Which company has better rates?

- Which company has better customer service?

- Which company offers better coverage options?

- Which company has better financial strength?

- Which company is more popular?

The answer to this question depends on your personal factors such as your age, location, driving record, and credit score. Both companies offer discounts for safe driving, bundling policies, and loyalty. It’s best to get quotes from both companies to compare rates.

Both Allstate and State Farm have strong customer service ratings according to J.D. Power’s annual studies. However, State Farm tends to have a higher rating overall. Additionally, State Farm has more agents nationwide, which could be beneficial for customers who prefer to work with an agent in person.

Both Allstate and State Farm offer a variety of coverage options for auto, home, life, and more. Allstate is known for its innovative coverage options such as Drivewise, which rewards safe driving habits, and Claim Satisfaction Guarantee, which promises customers will be satisfied with their claims experience. On the other hand, State Farm offers unique coverage options such as rideshare insurance for drivers who use their personal vehicles for ride-hailing services like Uber or Lyft.

Both Allstate and State Farm are financially stable companies with high ratings from A.M. Best, Moody’s, and Standard & Poor’s. However, State Farm has a higher financial strength rating from A.M. Best, which could give customers more peace of mind.

State Farm is the largest insurance company in the United States with over 19% market share, while Allstate is the second-largest with over 9% market share. State Farm also has more brand recognition and advertising presence, which could make it more familiar to potential customers.

Ultimately, the choice between Allstate and State Farm comes down to personal preferences and priorities. Both companies have their strengths and weaknesses, so it’s important to do your research and compare quotes before making a decision.