Table of Contents

Learn how to stop your bill in State Farm by following these simple steps. Avoid unnecessary charges and keep your finances in check.

Are you tired of paying high bills to State Farm? Do you want to know how to stop your bill from increasing? Look no further, because I have some tips and tricks that will help you save money and keep your budget in check. First and foremost, it’s important to understand the factors that contribute to your bill, such as your driving record, age, and type of coverage. By adjusting these variables, you can potentially lower your bill. But that’s not all- there are other ways to cut costs, such as bundling your insurance policies or raising your deductible. With a little bit of effort and knowledge, you can take control of your State Farm bill and stop overspending.

Are you tired of paying high bills in State Farm? Do you want to stop your bill and save some money? Look no further! In this article, we will discuss how you can stop your bill in State Farm and reduce your expenses.

Assess Your Insurance Coverage

The first step in stopping your bill in State Farm is to assess your insurance coverage. You may be paying for more coverage than you actually need. Review your policy and determine if there are any areas where you can reduce coverage or eliminate it altogether. For example, if you have an older car, you may not need collision coverage.

Bundle Your Policies

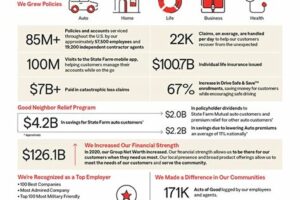

Another way to stop your bill in State Farm is to bundle your policies. If you have multiple insurance policies with different companies, consider consolidating them with State Farm. By bundling your policies, you can often receive a discount on your premiums.

Pay Your Bill in Full

If you are currently making monthly payments on your insurance policy, consider paying your bill in full. Many insurance companies, including State Farm, offer discounts to customers who pay their premiums in full. This can save you a significant amount of money over the course of a year.

Increase Your Deductible

Another way to stop your bill in State Farm is to increase your deductible. Your deductible is the amount of money you pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you can lower your monthly premium payments. Just make sure that you have enough money set aside to cover the higher deductible if you need to make a claim.

Take Advantage of Discounts

State Farm offers a variety of discounts to its customers. Make sure you are taking advantage of all the discounts that apply to you. Some common discounts include good student discounts, safe driver discounts, and multi-policy discounts.

Shop Around

If you are still not satisfied with your State Farm bill, consider shopping around for a new insurance provider. Get quotes from several different companies and compare coverage and prices. You may be able to find a better deal elsewhere.

Reduce Your Coverage

If you are really struggling to pay your State Farm bill, consider reducing your coverage. While it’s not ideal, having some insurance coverage is better than having none at all. Talk to your State Farm agent about your options and see if there are any areas where you can reduce your coverage.

Consider a Usage-Based Policy

State Farm offers a usage-based insurance program called Drive Safe & Save. This program uses telematics technology to track your driving habits and offer discounts based on how safe you drive. If you are a safe driver, this could be an excellent way to save money on your insurance premiums.

Ask for Assistance

If you are experiencing financial hardship and are struggling to pay your State Farm bill, don’t hesitate to ask for assistance. State Farm offers payment plans and assistance programs for customers who need help paying their premiums.

Conclusion

Stopping your bill in State Farm may seem like a daunting task, but there are many options available to help you reduce your expenses. Assess your coverage, bundle your policies, pay your bill in full, increase your deductible, take advantage of discounts, shop around, reduce your coverage, consider a usage-based policy, and ask for assistance if needed. By taking these steps, you can save money and achieve financial stability.

If you’re feeling overwhelmed by your State Farm bill, don’t panic. There are several steps you can take to stop your bill and ease your financial burden. The first step is to review your policy details to ensure you understand your coverage and the potential consequences of cancelling or reducing your coverage. Once you have a clear understanding of your policy, the next step is to contact your agent. Your agent can provide you with information about your options and help you make an informed decision. Consider changes to your policy, such as adjusting your coverage levels or deductibles to lower your payments. Discuss this possibility with your agent before making any changes. You may also want to research other insurance providers and compare rates to see if you can find a better deal elsewhere. Additionally, State Farm offers a variety of discounts such as safe driver, good student, and multi-policy discounts. Check with your agent to see if you qualify for any discounts that could lower your bill. When it comes to payment options, State Farm offers several choices including paying your bill all at once, quarterly, or monthly. Discuss these options with your agent to find the best one for your budget. You should also be aware of cancellation fees if you decide to cancel your State Farm policy. Make sure you understand these fees before taking any action. If you’re facing financial hardship, consider reducing your coverage temporarily to help lower your bill. Just make sure you understand the potential risks before taking this step. You could also ask your agent for a grace period if you’re struggling to pay your bill. This may provide you with extra time to get caught up on payments. Lastly, if you’re experiencing financial hardship, there are several programs that may be able to help you pay your insurance bills. Contact your local social services agency to find out what programs are available in your area. Remember, taking control of your State Farm bill starts with understanding your policy and exploring your options.

As a loyal State Farm customer for years, I have always appreciated their reliable service and quality coverage. However, there are times when unexpected financial situations arise, and I need to make changes to my billing plan. Here is my story on How Do I Stop My Bill In State Farm.

- First, I contacted my State Farm agent by phone to discuss my billing options and see if there were any discounts or cost-saving measures available. The agent was helpful and informative, and we went over my policy in detail to see where adjustments could be made.

- Next, I explored the State Farm website to see if I could manage my account online. I found that I could easily make changes to my billing preferences, such as switching to electronic statements or adjusting my payment schedule.

- Another option I considered was setting up automatic payments, which would ensure that my bill was paid on time every month without me having to worry about it. This feature was simple to set up and gave me peace of mind knowing that my payments would be taken care of.

- If all else fails, I could also cancel my policy altogether. While this is not an ideal scenario, it is important to know that this option is available if necessary. I would just need to contact my agent to discuss the cancellation process and any associated fees.

All in all, I found that stopping my bill in State Farm was a relatively painless process thanks to their helpful agents and user-friendly website. As a customer, I appreciate the flexibility and options available to me, and I feel confident knowing that I can make changes to my policy as needed to fit my changing financial circumstances.

Hey there, dear reader! I hope you found the information in this blog post helpful. It’s not uncommon to feel overwhelmed by the thought of dealing with bills and payments, especially when it comes to insurance. State Farm is a reputable insurance provider that offers a range of services to its customers, but sometimes it can be tricky to navigate their website or customer service channels.

If you’re looking to stop your bill with State Farm for any reason, rest assured that it’s a relatively simple process. The first step is to log in to your account on the State Farm website. From there, you’ll need to navigate to the Billing & Payments section, where you should see an option to Stop automatic payments. Click on that button, and you’ll be prompted to confirm that you want to stop your automatic payments.

Alternatively, you can call State Farm’s customer service line to request that your automatic payments be stopped. Be sure to have your account information handy, as well as any other relevant details that might be needed to verify your identity. The customer service representative should be able to assist you with stopping your payments and answer any questions you may have about the process.

In conclusion, stopping your bill with State Farm doesn’t have to be a daunting or stressful task. With a little bit of patience and persistence, you can easily navigate their website or customer service channels to get the job done. Remember, if you ever have any questions or concerns about your insurance policy or payments, don’t hesitate to reach out to State Farm’s customer service team for assistance. Thanks for reading, and best of luck with your insurance needs!

Video How Do I Stop My Bill In State Farm

When it comes to insurance, State Farm is one of the leading providers in the United States. However, there may come a time when you need to stop your bill for one reason or another. Here are some common questions people ask about how to stop their bill in State Farm:

- 1. Can I cancel my State Farm policy online?

- 2. What if I don’t want to cancel my policy entirely, but just want to stop my bill for a month?

- 3. How do I contact State Farm customer service to stop my bill?

- 4. Will I receive a refund if I cancel my State Farm policy mid-term?

Yes, you can cancel your State Farm policy online. You will need to log in to your account and navigate to the Account Info section. From there, you can select Cancel Policy and follow the prompts to complete the process.

If you need to stop your bill for a month, you can contact State Farm customer service and request a temporary suspension of your policy. Keep in mind that this option may not be available for all types of policies or in all states.

You can contact State Farm customer service by phone, email, or chat. To find the contact information for your specific policy, log in to your account and navigate to the Contact Us section.

Yes, you may be eligible for a refund if you cancel your State Farm policy mid-term. The amount of the refund will depend on the terms of your policy and how much of the term has already been paid for.

Stopping your bill in State Farm doesn’t have to be a difficult process. By following these simple steps and contacting customer service if you need assistance, you can ensure that your policy is up-to-date and meets your changing needs.