Table of Contents

Wondering how much State Farm life insurance costs per month? Get an estimate today and protect your family’s future with peace of mind.

Are you wondering about the cost of State Farm Life Insurance per month? Well, you’re not alone. Many people are interested in finding out how much they would need to budget for this type of coverage. Let’s face it; life insurance is an essential investment that can provide your loved ones with financial security and peace of mind in case of unexpected events. However, the cost of life insurance can vary depending on several factors, including age, health status, lifestyle, and coverage amount. That being said, we’ll explore the different factors that affect the cost of State Farm Life Insurance and give you an idea of what to expect in terms of monthly premiums. So, buckle up, and let’s dive into the world of life insurance costs!

When it comes to planning for the future, life insurance is an important consideration. State Farm is one of the largest providers of life insurance in the United States, but many people are left wondering: how much is State Farm life insurance per month? In this article, we will explore the different factors that can affect the cost of State Farm life insurance, as well as provide some estimates for monthly premiums.

Factors that Affect State Farm Life Insurance Premiums

Before we dive into the numbers, it’s important to understand the various factors that can impact the cost of your State Farm life insurance premiums. These can include:

- Age: Generally speaking, the younger you are when you purchase life insurance, the lower your premiums will be.

- Health: Your overall health and any pre-existing conditions can also impact your premiums. Those who are in good health will typically pay less than those who have health issues.

- Gender: Statistically, women tend to live longer than men, which means they may pay slightly lower premiums.

- Smoking Status: Smokers are at a higher risk for a variety of health issues, which means they will typically pay higher premiums than non-smokers.

- Policy Type: The type of life insurance policy you choose (such as term or whole life) can also impact your premiums.

- Coverage Amount: Naturally, the more coverage you require, the higher your premiums will be.

Estimating State Farm Life Insurance Premiums

Now that we understand the factors that can impact State Farm life insurance premiums, let’s take a look at some estimated costs. Keep in mind that these are just estimates and your actual premiums may vary based on your individual circumstances.

Term Life Insurance

Term life insurance is typically the most affordable type of life insurance, as it provides coverage for a set period of time (such as 10 or 20 years). Here are some estimated monthly premiums for State Farm term life insurance:

- A 30-year-old non-smoking male in good health could pay around $15 per month for a $250,000 policy.

- A 40-year-old non-smoking female in good health could pay around $21 per month for a $500,000 policy.

- A 50-year-old non-smoking male in good health could pay around $60 per month for a $1,000,000 policy.

Whole Life Insurance

Whole life insurance provides coverage for your entire lifetime and also includes a savings component. As a result, it tends to be more expensive than term life insurance. Here are some estimated monthly premiums for State Farm whole life insurance:

- A 30-year-old non-smoking male in good health could pay around $200 per month for a $100,000 policy.

- A 40-year-old non-smoking female in good health could pay around $300 per month for a $250,000 policy.

- A 50-year-old non-smoking male in good health could pay around $600 per month for a $500,000 policy.

How to Get a Quote for State Farm Life Insurance

If you’re interested in getting a more accurate estimate of how much State Farm life insurance will cost for your specific situation, the best course of action is to get a quote directly from State Farm. You can do this by visiting their website or calling their customer service number.

When getting a quote, be prepared to provide information about your age, health, smoking status, and desired coverage amount. This will ensure that you receive an accurate estimate of your monthly premiums.

The Bottom Line

So, how much is State Farm life insurance per month? The answer varies depending on a number of different factors, but generally speaking, term life insurance tends to be more affordable than whole life insurance. By understanding the factors that can impact your premiums and getting a quote directly from State Farm, you can make an informed decision about whether or not life insurance is right for you.

State Farm is a well-known insurance provider that offers life insurance policies to help protect your family’s financial future. One of the most critical factors when it comes to purchasing life insurance is the monthly premium cost. Fortunately, State Farm life insurance boasts affordable monthly premiums that can fit within most budgets.

Subheading 1: The Beauty of State Farm Life Insurance: Affordable Monthly Premiums

One of the primary reasons why State Farm is an excellent choice for life insurance coverage is because of its affordability. The company offers various policy options that come with different premium costs. This allows you to choose a plan that fits your needs and budget.

State Farm’s term life insurance, for example, is one of the most affordable policies offered by the company. With term life insurance, you pay a fixed premium for a specific period, usually between 10 and 30 years. If you pass away during the term, your beneficiaries receive a death benefit payout. The premiums for term life insurance policies are typically lower than those for permanent life insurance policies, making them more affordable for most people.

Subheading 2: The Average Cost of State Farm Life Insurance Based on Age and Gender

The cost of State Farm life insurance varies based on several factors, including age, gender, health, lifestyle, and the type of policy you choose. For instance, young and healthy individuals typically pay lower premiums than older and less healthy individuals.

According to State Farm, the average monthly premium for a 20-year term life insurance policy with a $250,000 death benefit is around $15 for a 25-year-old female non-smoker and around $18 for a 25-year-old male non-smoker. However, premiums increase as you get older and if you have underlying health conditions. For instance, a 50-year-old male non-smoker could expect to pay around $60 per month for the same policy, while a 50-year-old female non-smoker could expect to pay around $45 per month.

Subheading 3: How Your Health Affects the Cost of State Farm Life Insurance Per Month

Your health plays a significant role in determining the cost of your State Farm life insurance policy. The healthier you are, the lower your premiums will be. State Farm considers several health factors when determining your premium, such as your age, height, weight, medical history, and family medical history. If you have pre-existing conditions or a higher risk of developing certain diseases, you may pay higher premiums.

It’s worth noting that you’ll need to undergo a medical exam as part of the application process for most life insurance policies. The results of this exam can impact your premiums. If you’re healthy, you’ll likely get a lower premium, while if you have underlying health issues, you may pay more.

Subheading 4: Examining State Farm Term Life Insurance: Costs, Benefits & More

State Farm’s term life insurance is one of the most popular policies offered by the company. It provides coverage for a set period, typically between 10 and 30 years, and comes with affordable monthly premiums. With term life insurance, you’ll pay a fixed premium throughout the term, and if you pass away during this period, your beneficiaries will receive a death benefit payout.

The cost of State Farm term life insurance varies based on several factors, such as your age, gender, health, and lifestyle. Generally, younger and healthier individuals pay lower premiums than older and less healthy individuals. Additionally, the amount of coverage you choose can also impact your monthly premium.

Subheading 5: Is Whole Life Insurance from State Farm Affordable? A Look at Monthly Premiums

Whole life insurance is a permanent life insurance policy that provides coverage for your entire life and comes with a savings component. Unlike term life insurance, which has a set term and fixed premiums, whole life insurance can be more expensive because it offers lifelong coverage and an investment component.

State Farm’s whole life insurance policies come with higher monthly premiums than term life insurance policies. The cost of whole life insurance depends on several factors, including your age, gender, health, lifestyle, and the amount of coverage you choose. Generally, younger individuals pay lower premiums than older individuals, and healthier individuals pay lower premiums than those with underlying health conditions.

Subheading 6: Understanding the Variables that Affect State Farm Life Insurance Pricing

Several variables impact the cost of State Farm life insurance policies. Some of these variables include:

- Your age

- Your gender

- Your health

- Your lifestyle habits (smoking, alcohol use, etc.)

- The type of policy you choose (term or whole life insurance)

- The amount of coverage you select

- The length of your policy term

- The presence of riders (additional coverage options) on your policy

By understanding these variables, you can get a better idea of how to secure affordable life insurance coverage with State Farm.

Subheading 7: State Farm’s Life Insurance Riders: How They Impact Your Monthly Premiums

State Farm offers several life insurance riders that you can add to your policy for additional coverage. These riders provide extra protection and come with additional costs that will impact your monthly premium. Some of the most popular riders offered by State Farm include:

- Accelerated Death Benefit Rider

- Waiver of Premium Rider

- Children’s Term Rider

- Disability Income Rider

- Long-Term Care Rider

Before adding any riders to your policy, make sure to understand how they impact your monthly premium and whether the additional coverage is worth the added cost.

Subheading 8: Does State Farm Offer Life Insurance for Smokers: Costs & Benefits

If you’re a smoker, you may wonder if you can still get affordable life insurance coverage from State Farm. The answer is yes. State Farm offers life insurance policies for smokers, but the premiums are typically higher than those for non-smokers. Smoking is considered a high-risk behavior that can impact your health, so insurers charge more to offset that risk.

The cost of life insurance for smokers varies based on several factors, including your age, gender, health, lifestyle, and the type of policy you choose. However, even as a smoker, you can still find affordable life insurance coverage with State Farm.

Subheading 9: How to Get the Best Rates for State Farm Life Insurance Per Month

If you’re looking to get the best rates for State Farm life insurance per month, there are several things you can do. Here are a few tips:

- Choose a term life insurance policy over whole life insurance

- Opt for a shorter policy term (e.g., 10 years instead of 30 years)

- Quit smoking or using other tobacco products

- Lose weight and maintain a healthy lifestyle

- Undergo regular medical check-ups to detect and treat any health conditions early

- Compare quotes from multiple insurers to get the best rates

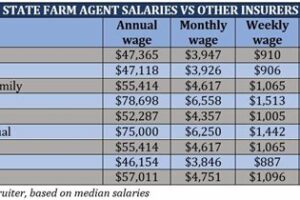

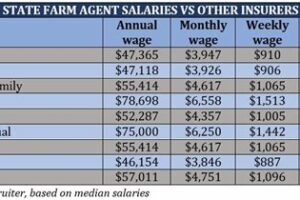

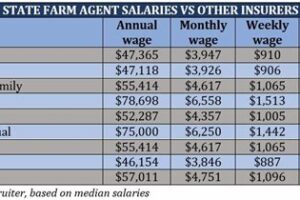

Subheading 10: Comparing State Farm Life Insurance with Competitors: How the Cost Stacks Up

When it comes to life insurance, State Farm is just one of many providers you can choose from. To ensure you’re getting the best rates, it’s essential to compare quotes from different insurers and see how their costs stack up.

Overall, State Farm’s life insurance policies come with affordable monthly premiums, making them a great choice for many individuals. However, the cost of your policy will depend on several factors, including your age, gender, health, and lifestyle. By comparing quotes from multiple insurers, you can find the best rates and coverage options for your needs.

In conclusion, State Farm offers affordable life insurance policies that can fit within most budgets. Whether you opt for term or whole life insurance, make sure to understand the variables that impact your monthly premium and choose a policy that fits your needs and financial situation.

As a fictional character navigating through life’s uncertainties, I often find myself wondering about the future. I want to ensure that my loved ones are taken care of in case anything happens to me. That’s why I decided to research life insurance policies, specifically State Farm.

How Much Is State Farm Life Insurance Per Month?

- State Farm offers term life insurance with coverage amounts ranging from $100,000 to $3 million. The cost of the policy depends on various factors such as age, gender, health, and lifestyle habits.

- For example, a healthy 30-year-old non-smoking male can expect to pay around $20-25 per month for a 20-year term policy with a $500,000 death benefit.

- On the other hand, a 50-year-old with a history of medical issues and smoking habit may have to pay up to $150 per month for the same coverage amount and term length.

It’s important to note that these are just estimates. The only way to know for sure how much your State Farm life insurance policy will cost is to get a personalized quote based on your individual circumstances.

Overall, State Farm offers competitive rates for term life insurance. They also have a strong financial rating and reputation for excellent customer service, making them a reputable choice for those seeking life insurance.

As a fictional character, I may not have a family to protect, but I understand the importance of being prepared for the unexpected. Whether you’re young and healthy or older with a few health concerns, State Farm has options to fit your needs and budget. It’s comforting to know that even if the worst were to happen, your loved ones will be taken care of.

Thank you for taking the time to read this article on how much State Farm life insurance costs per month. It’s important to understand the different factors that go into determining the cost of life insurance, including your age, health, and lifestyle habits. By working with a State Farm agent, you can get a personalized quote that takes all of these factors into account.One thing to keep in mind is that life insurance isn’t just about protecting yourself – it’s also about protecting your loved ones. If something were to happen to you, having life insurance can provide financial support to help your family pay for expenses like funeral costs, outstanding debts, and ongoing living expenses. This can bring peace of mind knowing that your loved ones will be taken care of in the event of your passing.When shopping for life insurance, it’s important to look beyond just the monthly premium. You’ll also want to consider the coverage amount, policy term, and any additional benefits or riders that may be available. A State Farm agent can help you understand all of your options and find a policy that fits your unique needs and budget.In conclusion, State Farm life insurance costs vary depending on several factors, and the only way to get an accurate quote is to speak with an agent. However, by taking the time to research your options and work with a knowledgeable professional, you can find a policy that provides the coverage you need at a price you can afford. Thank you for reading, and we wish you the best of luck in your search for life insurance coverage!

.

People often wonder about the cost of State Farm Life Insurance. Here are some common questions and answers:

- How much is State Farm Life Insurance per month?

- What factors affect the cost of State Farm Life Insurance?

- Age

- Health

- Gender

- Smoking status

- Policy type (term, whole, universal)

- Coverage amount

- Length of policy

- Is State Farm Life Insurance affordable?

- Can I get a quote for State Farm Life Insurance online?

The cost of State Farm Life Insurance varies depending on several factors, including your age, health, and the type of policy you choose. For example, a healthy 30-year-old might pay around $20 per month for a 20-year term life insurance policy with a coverage amount of $250,000. However, prices can range from $10 to $100 or more per month depending on individual circumstances.

Several factors can impact the cost of your State Farm Life Insurance policy:

State Farm offers competitive rates for life insurance, and many policies are affordable for most people. It’s important to shop around and compare rates from different providers to find the best policy for your needs and budget. State Farm also offers discounts for bundling multiple policies, such as home and auto insurance, which can help reduce the overall cost.

Yes, State Farm offers an online quote tool that allows you to estimate the cost of various life insurance policies. You can enter your basic information and receive a quote within minutes. However, keep in mind that the actual cost may vary depending on your individual circumstances, so it’s best to speak with an agent for a more accurate estimate.

Overall, the cost of State Farm Life Insurance varies depending on many factors, but it’s often affordable and competitive with other providers. By comparing rates and policy options, you can find the right coverage at a price that fits your budget.