Table of Contents

Wondering how much you can save on car insurance with State Farm’s low mileage discount? Find out now and start saving money on your premiums.

Are you looking for ways to save money on your car insurance premiums? State Farm offers a low mileage discount that could help you do just that. By driving less, you can reduce the wear and tear on your vehicle and lower your risk of getting into an accident. Plus, with State Farm’s discount program, you could enjoy significant savings on your monthly car insurance payments. But how much of a discount can you expect to receive? Let’s take a closer look at what State Farm has to offer.

State Farm is one of the largest insurance companies in the United States, providing coverage for auto, home, and life insurance. One of the benefits that State Farm offers is the Low Mileage Discount, which provides a savings on car insurance premiums for drivers who drive fewer miles than the average driver. Here’s what you need to know about State Farm’s Low Mileage Discount.

What is the Low Mileage Discount?

The Low Mileage Discount is a discount that State Farm offers to drivers who drive their cars less frequently than the average driver. The discount is typically applied to drivers who drive less than 7,500 miles per year, but the exact mileage requirements may vary depending on the state in which you live.

How Much is the Discount?

The amount of the Low Mileage Discount varies depending on several factors, including your driving record, the type of car you drive, and your location. On average, the discount can range from 5% to 15% off your premium.

How Can You Qualify for the Discount?

In order to qualify for the Low Mileage Discount, you will need to provide documentation that shows your annual mileage. This can include odometer readings or other proof of the number of miles you have driven over the course of a year.

Why Does State Farm Offer the Discount?

State Farm offers the Low Mileage Discount as a way to reward drivers who drive less frequently and are therefore less likely to be involved in accidents. By encouraging drivers to drive less, State Farm can reduce its risk of having to pay out claims for accidents.

Can You Combine the Low Mileage Discount with Other Discounts?

Yes, you can typically combine the Low Mileage Discount with other discounts that State Farm offers, such as the Safe Driver Discount or the Multiple Vehicle Discount. However, the exact discounts and eligibility requirements may vary depending on your location.

What Are Some Other Ways to Save Money on Car Insurance?

In addition to the Low Mileage Discount, there are several other ways that you can save money on car insurance. Here are a few tips:

- Shop around and compare quotes from multiple insurance companies

- Bundle your auto insurance with other types of insurance, such as home or life insurance

- Choose a higher deductible

- Take advantage of discounts for things like good grades or completing a driver’s education course

Final Thoughts

If you are a low-mileage driver, the Low Mileage Discount from State Farm could help you save money on your car insurance premiums. Be sure to check with your local State Farm agent to see if you qualify for the discount, and don’t forget to explore other ways to save on car insurance as well.

State Farm offers a Low Mileage Discount to its customers who drive less than a certain number of miles per year. This discount is a way for State Farm to reward customers who are less likely to be involved in accidents due to their reduced time on the road.

So, how does State Farm define “low mileage”? According to the insurer, a low mileage driver is someone who drives less than 7,500 miles per year. However, this number may vary depending on the state in which you live. It is important to check with your local State Farm agent to confirm the specific requirements for your area.

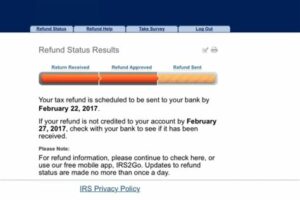

If you meet the low mileage criteria, you could qualify for a discount on your car insurance premium. To qualify, you will need to provide State Farm with an accurate estimate of your annual mileage. This can typically be done through self-reporting or by allowing State Farm to track your driving habits with a telematics device.

The percentage of discount for low mileage customers varies by state but can range from 5% to 45%. The higher the percentage, the more you will save on your insurance premium. It is important to note that this discount is applied to the liability, collision, and comprehensive portions of your policy but not on any optional coverages such as roadside assistance or rental car coverage.

While there is no specific limitation on how much you can save with the low mileage discount, it is important to maintain a low mileage rate over the years. This is because State Farm may periodically review your driving habits to ensure that you still qualify for the discount. If your mileage increases significantly, you may lose the discount, resulting in a higher premium.

Aside from the potential financial savings, maintaining a low mileage rate can also benefit your overall safety and well-being. By driving less frequently, you are reducing your risk of being involved in a car accident. Additionally, less time on the road can help reduce stress and improve your mental health.

When it comes to coverage and protection, the low mileage discount does not impact the level of coverage provided by State Farm. You will still have the same level of protection as other customers who do not qualify for the discount. The only difference is the amount of money you will pay for your premium.

While State Farm’s low mileage discount may vary by state, it is generally comparable to discounts offered by other insurers. However, it is important to compare the specific terms and requirements of each insurer to determine which offer is best for your individual needs.

To calculate your potential savings from the low mileage discount, you will need to know your current annual mileage and the percentage of discount offered in your state. For example, if you currently drive 6,000 miles per year and are eligible for a 15% discount, you could potentially save $150 per year on your insurance premium.

If you are interested in claiming the low mileage discount, there are a few dos and don’ts to keep in mind. Do accurately report your annual mileage to State Farm. Don’t underestimate your mileage to try and qualify for the discount, as this could result in a loss of coverage in the event of an accident. Do maintain a low mileage rate over time and notify State Farm if your driving habits change significantly. Don’t forget to compare the low mileage discount with other available discounts to ensure that you are getting the best deal possible.

Overall, the low mileage discount offered by State Farm can be a great way to save money on your car insurance premium. By driving less frequently and maintaining a low mileage rate over time, you could potentially save hundreds of dollars each year while also benefiting your overall well-being and safety on the road.

Once upon a time, there was a young man named Jack who bought his first car. He was excited to hit the road and explore new places, but he was also concerned about the cost of insurance.

Luckily, Jack had heard about the Low Mileage Discount offered by State Farm. This discount rewards drivers who don’t put a lot of miles on their cars each year, and can save them money on their insurance premiums.

Curious about how much he could save, Jack decided to call State Farm and ask about their Low Mileage Discount. Here’s what he learned:

- The Low Mileage Discount is available to drivers who drive less than a certain number of miles each year. The exact number of miles varies by state, but it’s usually around 7,500 miles per year.

- The amount of the discount varies depending on a number of factors, including your driving record, the type of car you drive, and your location.

- In general, drivers can expect to save between 5% and 10% on their insurance premiums with the Low Mileage Discount.

- To qualify for the discount, you’ll need to provide proof of your mileage, such as an odometer reading or a GPS tracker.

- If you’re not sure whether you qualify for the Low Mileage Discount, it’s always a good idea to call your insurance company and ask. They’ll be happy to help you find ways to save money on your insurance.

With this information in hand, Jack was able to make an informed decision about his insurance coverage. He signed up for the Low Mileage Discount and was able to save money on his monthly premiums, which allowed him to enjoy more road trips and adventures in his new car.

So, if you’re a driver who doesn’t put a lot of miles on your car each year, be sure to ask your insurance company about the Low Mileage Discount. You never know how much money you could save!

Well, folks, we’ve reached the end of our discussion about how much is the low mileage discount from State Farm. Hopefully, you’ve found this article informative and helpful in your search for the best car insurance policy out there.

As a quick recap, State Farm offers a low mileage discount for drivers who travel less than a certain amount each year. This discount can range from 5% to 50%, depending on your state, driving habits, and other factors. To find out exactly how much you could save, it’s best to contact State Farm directly and get a quote based on your personal situation.

Finally, it’s worth noting that while the low mileage discount can certainly help you save on your car insurance premiums, it’s not the only factor to consider when choosing an insurance policy. Other important factors include coverage limits, deductibles, and the level of customer service provided by the insurance company.

At the end of the day, finding the right car insurance policy requires a bit of research and comparison shopping. But with the help of tools like the low mileage discount from State Farm, you can ensure that you’re getting the best possible coverage at a price that fits your budget.

Thank you for reading this article, and we wish you all the best in your search for the perfect car insurance policy!

.

People also ask about How Much Is Low Mileage Discount State Farm:

- What is the low mileage discount offered by State Farm?

- How much money can I save with State Farm’s low mileage discount?

- What are the requirements to qualify for State Farm’s low mileage discount?

- You must be a State Farm policyholder

- Your vehicle must be less than 10 years old

- You must drive less than a certain number of miles per year (varies by state)

- You must provide proof of your annual mileage, such as through an odometer reading or a self-certification form

- Is the low mileage discount worth it?

The low mileage discount offered by State Farm is a discount given to drivers who drive less than a certain number of miles per year. The exact number of miles required to qualify for this discount varies by state, but it typically ranges from 7,500 to 15,000 miles per year.

The amount of money you can save with State Farm’s low mileage discount depends on several factors, including your driving habits, the number of miles you drive per year, and the state you live in. However, on average, drivers who qualify for this discount can save around 5-10% on their car insurance premiums.

To qualify for State Farm’s low mileage discount, you must meet certain requirements, including:

If you are a driver who does not drive many miles each year, then the low mileage discount offered by State Farm could be worth it for you. This discount can help you save money on your car insurance premiums, which can be particularly beneficial if you are on a tight budget. However, if you drive a lot of miles each year, then you may not qualify for this discount and it may not be worth pursuing.