Looking for financing options for farm equipment? Discover how you can easily acquire the necessary funds to purchase or lease agricultural machinery. Explore flexible repayment plans and low-interest rates tailored to meet... Read more »

Looking for a loan to purchase farm equipment? Our farm equipment loan offers flexible terms and competitive rates. Whether you need tractors, harvesters, or irrigation systems, we can help you finance the... Read more »

Looking for farm equipment finance? Our company offers flexible financing options for buying or leasing agricultural machinery. Whether you need tractors, harvesters, or other farming equipment, we provide competitive rates and quick... Read more »

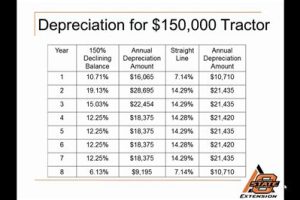

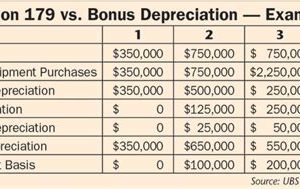

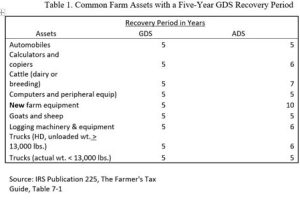

Farm equipment depreciation refers to the decrease in value of agricultural machinery and tools over time. Understanding this concept is crucial for farmers, as it helps them calculate the true cost of... Read more »

Depreciation for farm equipment is a crucial aspect of managing agricultural operations. This article explores the concept of depreciation, its significance in the farming industry, and how it affects the financial health... Read more »

Looking for accounting software specifically designed for farm businesses? Our accounting software for farm business offers an efficient and user-friendly solution to manage your finances, track expenses, and analyze your agricultural operations.... Read more »

Starting a farm business for tax purposes can provide numerous benefits and deductions. Learn about the tax advantages, exemptions, and credits available to farmers. Discover how to navigate tax regulations, recordkeeping requirements,... Read more »

Find out if you can write off the cost of your farm animals on your taxes. Learn the rules and regulations before claiming deductions. Read more »

Wondering if you can depreciate your farm animals for tax purposes? Learn about the rules and regulations for agriculture depreciation here. Read more »

Curious if you can claim farm animals on your taxes? Find out how these furry and feathered friends can impact your tax return. Read more »