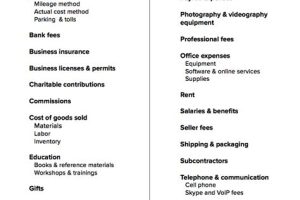

Starting a farm business for tax purposes can provide numerous benefits and deductions. Learn about the tax advantages, exemptions, and credits available to farmers. Discover how to navigate tax regulations, recordkeeping requirements,... Read more »

Looking to buy or sell used farm equipment? Look no further! Our platform offers a wide range of high-quality, reliable used farm equipment at competitive prices. Whether you need tractors, harvesters, or... Read more »

Find out if you can write off the cost of your farm animals on your taxes. Learn the rules and regulations before claiming deductions. Read more »

Discover if State Farm offers gap insurance and learn how this type of coverage can protect you financially in case of a total loss on your vehicle. Read more »

Find out if State Farm car loans include gap insurance. Protect your investment and avoid financial loss in case of an accident or theft. Read more »

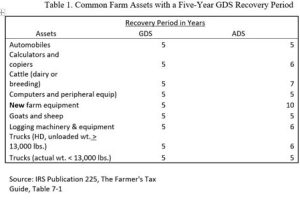

Wondering if you can depreciate your farm animals for tax purposes? Learn about the rules and regulations for agriculture depreciation here. Read more »

Curious about deducting the cost of farm animals on your taxes? Learn more about the rules and regulations surrounding this deduction. #taxes #farming #deductions Read more »

Learn if you can deduct expenses for your farm animals with our comprehensive guide. Maximize your tax savings and keep your farm running smoothly. Read more »

Wondering if State Farm’s broadened collision coverage pays for replacement costs? Learn more about this auto insurance feature in this informative guide. Read more »

Are your farm animals a write off? Learn how to properly depreciate livestock and other farm assets on your taxes with our guide. Read more »