Learn how State Farm Life Insurance works and how it can provide financial protection for your loved ones in the event of your unexpected passing. Read more »

Did you know that farm animals were once claimed as dependents on taxes? Learn about this quirky piece of history and its implications for farmers. Read more »

Is selling farm animals considered a capital gain? Learn about the tax implications of selling livestock and other farm animals. Read more »

The Farming Business Code is a comprehensive guide for entrepreneurs looking to start or expand their farming business. This code provides valuable insights into various aspects of agriculture, including crop selection, livestock... Read more »

Wondering if State Farm offers free TurboTax? Check out this article to learn more about their tax preparation services. Read more »

Wondering if State Farm offers free tax filing? Find out how you can take advantage of this service and save money on your taxes. Read more »

Wondering if State Farm offers financial planning? Get the answer here. Find out how State Farm can help you with your financial goals. Read more »

Are you looking to invest in the lucrative farm land business? Discover the potential of owning and operating a farm land, where you can cultivate crops, raise livestock, or even lease the... Read more »

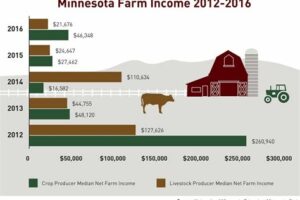

Farm income and business income are two different sources of revenue with their own unique characteristics. Farm income refers to the money earned from agricultural activities such as crop cultivation or livestock... Read more »

Farm Business Services provides comprehensive financial and consulting solutions for farmers and agricultural businesses. Our team of experts offers personalized advice on tax planning, bookkeeping, payroll management, and financial analysis. Trust us... Read more »