State Farm may drop you if your driving history is poor, you file too many claims or if you commit fraud. Make sure you’re a responsible driver! Read more »

State Farm may cancel your insurance for several reasons, including non-payment, fraud, or an increase in risk factors. Learn more about why this may happen. Read more »

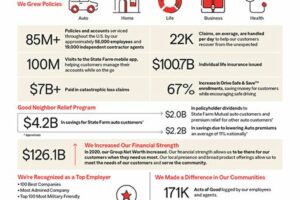

State Farm Insurance rates are increasing due to rising costs of claims and natural disasters, leading to higher premiums for policyholders. Read more »

Wondering why your State Farm insurance rates are increasing? Find out the possible reasons and ways to save on premiums in this informative article. Read more »

Curious why your State Farm bill is lower than expected? Factors like good driving habits, low claims history, and discounts could be the reason. Read more »

Before Jake From State Farm, there was a whole cast of characters in the iconic insurance commercials. Learn about their history and significance. Read more »

State Farm In-Drive Monitor is a telematics program that tracks driving behavior, rewards safe driving, and helps improve driving habits. Read more »

Learn how to build your retirement savings by contributing to a Roth IRA with State Farm. Get started today and secure your financial future. Read more »

Find out what qualifies as an at-fault loss with State Farm insurance. Learn how accidents impact your coverage and premiums. Read more »

Unlock Savings with State Farm Drive Safe & Save: A Guide to Connecting and Saving on Auto Insurance

Learn how to connect to State Farm Drive Safe & Save and save money on auto insurance. Get tips and tricks for using the program. Read more »