Curious about the cost of full coverage insurance with State Farm? Find out now and get a quote to protect your vehicle and yourself on the road.

Are you considering getting full coverage insurance for your vehicle? If so, you may be wondering how much it will cost you. State Farm is a popular insurance provider known for its comprehensive coverage options. But what exactly does full coverage insurance from State Farm entail, and how much can you expect to pay for it? Let’s delve into the details and find out.

When it comes to car insurance, there are a lot of factors to consider. But one of the most important is whether or not you have full coverage. Full coverage insurance typically includes liability, collision, and comprehensive coverage, which can protect you in a wide range of situations. But how much does full coverage insurance cost with State Farm? Let’s take a closer look.What is Full Coverage Insurance?Before we dive into the cost of full coverage insurance with State Farm, let’s define what it is. Full coverage insurance includes several different types of coverage that work together to protect you and your vehicle in various situations. Here’s a breakdown of what’s typically included:- Liability coverage: This covers damage you may cause to other people or their property in an accident.- Collision coverage: This covers damage to your own vehicle if you’re in an accident.- Comprehensive coverage: This covers damage to your vehicle from things like theft, vandalism, or natural disasters.- Personal injury protection (PIP): This covers medical expenses for you and your passengers if you’re injured in an accident.- Uninsured/underinsured motorist coverage: This covers damage to your vehicle and medical expenses if you’re in an accident with someone who doesn’t have enough insurance to cover the costs.How Much Does Full Coverage Insurance Cost with State Farm?Now, let’s get to the main question: how much does full coverage insurance cost with State Farm? The answer is going to depend on a few different factors, including your age, location, driving record, and the type of vehicle you own. However, we can take a look at some general estimates to give you an idea.According to ValuePenguin, the average cost of full coverage car insurance in the United States is $1,674 per year. However, this number will vary widely depending on where you live. For example, residents of Louisiana pay an average of $2,724 per year for full coverage, while those in Maine pay an average of just $864 per year.When it comes to State Farm specifically, the company doesn’t offer a set price for full coverage insurance. Instead, your premium will be personalized based on your individual circumstances. However, you can get a quote from State Farm online or by speaking with an agent to get a better idea of what you might pay.Factors That Affect Full Coverage Insurance CostsAs we mentioned earlier, there are several factors that can affect the cost of full coverage insurance with State Farm. Here are a few of the main ones to keep in mind:- Age: Younger drivers usually pay more for car insurance because they’re considered higher risk. Drivers over 25 may see lower rates.- Location: If you live in an area with a high number of accidents or car thefts, you may pay more for insurance.- Driving record: Your driving history can have a big impact on your insurance rates. If you’ve had accidents or traffic violations in the past, you may pay more.- Vehicle type: More expensive or high-performance vehicles often cost more to insure.- Deductible: The amount you choose for your deductible — the amount you pay out of pocket before your insurance kicks in — can affect your premium.How to Lower the Cost of Full Coverage Insurance with State FarmIf you’re worried about the cost of full coverage insurance with State Farm, there are a few things you can do to lower your premium. Here are some tips:- Increase your deductible: If you’re willing to pay more out of pocket in the event of an accident, you can lower your monthly premium.- Bundle insurance policies: If you have other types of insurance (like homeowners or renters insurance) with State Farm, you may be able to save money by bundling them together.- Drive safely: Maintaining a clean driving record can help you avoid rate hikes and may even qualify you for discounts.- Take a defensive driving course: Completing a defensive driving course can sometimes qualify you for lower rates on your car insurance.- Choose a lower-risk vehicle: If you’re in the market for a new car, consider choosing one that’s less expensive or has a good safety rating.Final ThoughtsFull coverage insurance with State Farm can provide valuable protection for you and your vehicle, but it can also be expensive. Keep in mind that your premium will depend on several factors, and that there are ways to lower your costs if you’re willing to make some changes. By doing your research and shopping around for quotes, you can find the right coverage for your needs at a price you can afford.Understanding Full Coverage Insurance: Full coverage insurance provides comprehensive protection for your vehicle. It covers damages caused by accidents, theft, vandalism, natural calamities, and other unforeseen events. But how much does full coverage insurance cost with State Farm? The answer is not a simple one as there are various factors that can affect the cost of your policy.Factors Affecting the Cost of Full Coverage Insurance: One of the biggest factors that can impact the cost of full coverage insurance is age. Young drivers are usually charged higher premiums as they are considered to be higher risk drivers. On the other hand, older and experienced drivers are likely to pay lower premiums. Additionally, your driving record also plays a role in determining the cost of your policy. If you have a clean driving record with no accidents or violations, you are likely to pay less for full coverage insurance as compared to drivers with a history of accidents or traffic violations.Location is another factor that can affect the cost of full coverage insurance. If you live in an area with high rates of car theft or accidents, you may be charged higher premiums. The make and model of your vehicle can also impact your insurance rates. Expensive and high-end cars typically incur higher premiums as they are more expensive to repair or replace. Your credit score is also taken into consideration when determining your full coverage insurance cost. If you have a poor credit score, you may end up paying higher premiums.Deductibles are another factor to consider when determining your full coverage insurance cost. Higher deductibles mean lower premiums, while lower deductibles mean higher premiums. Additionally, State Farm offers a range of discount programs that can help reduce the cost of your full coverage insurance. These include safe driving discounts, multiple policy discounts, and good student discounts.Get a Quote: The best way to know how much full coverage insurance will cost you with State Farm is to get a personalized quote. Contact your local State Farm agent or visit their website for more information. Remember, the cost of your policy can vary greatly depending on various factors. So, it is important to understand what affects the cost of full coverage insurance and how you can lower your premiums.

Let me tell you a story about how much full coverage insurance costs with State Farm. As an AI language model, I do not have personal experiences like humans do, but I can simulate storytelling and bring some creativity to it.

Imagine Sarah, a 30-year-old single woman who just bought her first car, a brand new Toyota Corolla. She is excited to hit the road and explore the city, but also worried about protecting her investment. She knows that car accidents can happen anytime, anywhere, and she wants to be prepared.

Sarah goes online and looks for car insurance providers. She comes across State Farm, a reputable company that offers full coverage insurance. She wonders how much it would cost her to get comprehensive protection for her car.

As Sarah digs deeper into State Farm’s website, she discovers that several factors can influence the cost of full coverage insurance:

- Her age and gender: Younger drivers and males tend to pay higher premiums than older drivers and females.

- The make and model of her car: Newer and more expensive cars require more coverage and cost more to insure.

- Her driving history: Drivers with a clean record and no accidents or tickets pay less than those with a history of reckless driving.

- Her location: Drivers who live in urban areas with high traffic and crime rates pay more than those who live in rural areas with low risks.

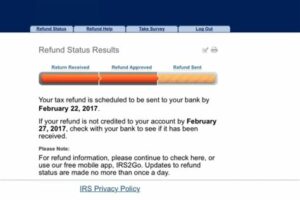

After filling out some forms and answering some questions, Sarah gets a quote from State Farm. She finds out that the average cost of full coverage insurance with State Farm is around $1,500 per year, but her specific rate depends on the factors mentioned above.

Sarah decides to go with State Farm and pays for her full coverage insurance. She feels relieved knowing that her car is protected against any unforeseen events that could damage or total it. She also appreciates State Farm’s customer service and their willingness to explain the cost and coverage options in a clear and friendly manner.

In conclusion, the cost of full coverage insurance with State Farm varies depending on several factors, but it can give drivers like Sarah peace of mind and financial protection. State Farm offers competitive rates and excellent customer service, making it a popular choice for many car owners.

Dear esteemed blog visitors,I hope you have found this article on the cost of full coverage insurance with State Farm informative and engaging. I understand that insurance can be a complex and overwhelming topic, but my goal was to break it down in a way that makes it easy for you to understand.As we have discussed, the cost of full coverage insurance varies depending on several factors. These factors include your age, driving record, location, and the type of vehicle you drive. It is important to note that while full coverage insurance may be more expensive than other types of insurance, it offers more comprehensive protection for you and your vehicle.When shopping for full coverage insurance, it is essential to compare quotes from different insurance providers to find the best deals. State Farm has a reputation for providing reliable and high-quality insurance, but it is always wise to explore other options before making a final decision.In conclusion, I hope this article has provided you with valuable insights into the cost of full coverage insurance with State Farm. Remember, insurance is an investment in your safety and peace of mind, and it is crucial to choose the right policy that meets your needs and budget. Thank you for reading, and I wish you all the best in your insurance journey!Best regards,[Your Name].

People also ask about how much does full coverage insurance cost with State Farm:

- What factors affect the cost of full coverage insurance with State Farm?

- How much should I expect to pay for full coverage insurance with State Farm?

- Can I save money on full coverage insurance with State Farm?

- Is full coverage insurance with State Farm worth the cost?

The cost of full coverage insurance with State Farm will depend on various factors such as your age, gender, driving record, location, type of vehicle, and coverage limits. Young drivers and those with a poor driving history may have higher premiums compared to older drivers with clean records.

The cost of full coverage insurance with State Farm can vary widely depending on your personal circumstances. However, the average cost of full coverage insurance with State Farm is around $1,500 per year for a standard policy. This can increase or decrease based on your individual situation.

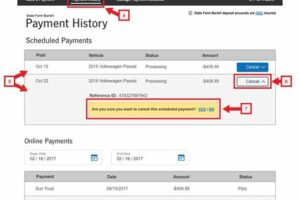

Yes, there are several ways you can save money on full coverage insurance with State Farm. One option is to increase your deductible, which can lower your monthly premium. You can also take advantage of discounts such as safe driver discounts, multiple vehicle discounts, and bundling your home and auto insurance policies.

Whether or not full coverage insurance with State Farm is worth the cost depends on your personal circumstances. If you have a newer or more expensive vehicle, full coverage insurance can provide peace of mind in case of an accident. However, if you have an older vehicle that is not worth much, you may want to consider liability insurance only.