Table of Contents

Wondering if State Farm offers rideshare insurance in New York State? Find out all the details here and ensure you have the coverage you need.

Are you a rideshare driver in New York State? If so, you may be wondering if your auto insurance policy covers you while driving for companies like Uber or Lyft. While many insurance providers offer rideshare coverage, one of the most popular options is State Farm.

But does State Farm really offer rideshare insurance in New York State? The answer is yes – and it’s important to know the details if you’re a driver for a rideshare company. With State Farm’s rideshare coverage, you can have peace of mind knowing that you’re protected on the road, whether you’re driving for personal use or as part of your rideshare job.

So, what exactly does State Farm’s rideshare insurance cover in New York State? And how does it compare to other options? Keep reading to find out everything you need to know about State Farm’s rideshare coverage for New York drivers.

State Farm is an insurance company that offers various types of insurance policies to its customers. With the rise of ridesharing services like Uber and Lyft, there has been a growing demand for insurance policies that cater to the needs of rideshare drivers. In this article, we explore whether State Farm offers rideshare insurance in New York State.

What is Rideshare Insurance?

Rideshare insurance is an insurance policy that covers drivers who use their personal vehicles to transport passengers for a fee. These drivers are typically associated with popular ridesharing services like Uber and Lyft. Rideshare insurance policies are designed to fill the gaps in coverage that may exist between a driver’s personal auto insurance policy and the coverage provided by the ridesharing company.

Does State Farm Offer Rideshare Insurance?

Yes, State Farm does offer rideshare insurance in certain states. However, the availability of this type of insurance varies depending on the state in which you reside.

Is Rideshare Insurance Available in New York State?

Yes, rideshare insurance is available in New York State through State Farm. The insurance policy is called the Transportation Network Coverage Endorsement and it provides coverage for drivers who use their personal vehicles for ridesharing purposes.

What Does the Transportation Network Coverage Endorsement Cover?

The Transportation Network Coverage Endorsement provides coverage for three different periods:

- Period 1: This period begins when the driver turns on the ridesharing app and is waiting for a ride request. During this period, State Farm provides liability coverage up to $50,000 per person, $100,000 per accident, and $25,000 for property damage.

- Period 2: This period begins when the driver accepts a ride request and is en route to pick up the passenger. During this period, State Farm provides liability coverage up to $1 million.

- Period 3: This period begins when the passenger enters the vehicle and ends when the passenger exits the vehicle. During this period, State Farm provides liability coverage up to $1 million, as well as coverage for collision and comprehensive damage to the vehicle.

How Much Does Rideshare Insurance Cost?

The cost of rideshare insurance varies depending on a number of factors, including the state in which you reside, your driving record, and the make and model of your vehicle. However, State Farm offers competitive rates for its Transportation Network Coverage Endorsement.

How Do I Get Rideshare Insurance from State Farm?

If you are interested in purchasing rideshare insurance from State Farm, you can contact your local State Farm agent for more information. They will be able to provide you with a quote and help you understand the coverage options available.

Conclusion

Rideshare insurance is an important type of coverage for drivers who use their personal vehicles for ridesharing purposes. State Farm offers rideshare insurance in New York State through its Transportation Network Coverage Endorsement. This policy provides coverage for drivers during all three periods of a rideshare trip, ensuring that they are protected in the event of an accident or other incident. If you are a rideshare driver in New York State, it is important to consider purchasing rideshare insurance to ensure that you are adequately covered.

Are you a rideshare driver in New York State? If so, you may want to consider getting rideshare insurance to protect yourself and your passengers while on the job. But what is rideshare insurance, and does State Farm offer it in New York State?

Rideshare insurance is a type of auto insurance specifically designed for drivers who work for companies like Uber and Lyft. Since personal auto insurance policies typically exclude coverage for commercial use, rideshare drivers need additional coverage to fill the gaps.

The need for rideshare insurance in New York State is especially pressing due to the state’s strict insurance laws. In fact, New York is one of the few states that requires rideshare drivers to carry commercial auto insurance at all times, regardless of whether they have a passenger in the car or not. This means that if you’re caught driving without proper insurance, you could face fines, license suspension, or even criminal charges.

So, does State Farm offer rideshare insurance in New York State? The answer is yes! State Farm offers coverage options for rideshare drivers in most states, including New York. However, not all policies are created equal, and it’s important to understand the specifics of State Farm’s coverage before signing up.

To be eligible for State Farm’s rideshare insurance, you must already have a personal auto insurance policy with the company. You’ll also need to provide proof of your rideshare employment and the amount of coverage required by your rideshare company. Once these requirements are met, you can add rideshare coverage to your existing policy for an additional premium.

State Farm’s rideshare insurance offers coverage limits and deductibles that are similar to their personal auto policies. However, there are some additional benefits that are specific to rideshare drivers. For example, State Farm’s coverage includes gap coverage, which fills the gap between your rideshare company’s insurance and your own policy if there is a coverage lapse. They also offer coverage for medical payments and uninsured/underinsured motorists.

So, how much does State Farm’s rideshare insurance cost in New York State? The cost will vary depending on factors like your driving record, the type of vehicle you drive, and the amount of coverage you need. However, in general, rideshare insurance tends to be more expensive than personal auto insurance due to the increased risk associated with driving for hire.

It’s important to note that there are some differences between State Farm’s rideshare insurance and their personal auto policies. For example, rideshare insurance typically covers you when you have a passenger in the car, but not necessarily when you’re waiting for a ride request. If you’re using your car for personal use outside of your rideshare job, you’ll still need to rely on your personal auto policy for coverage.

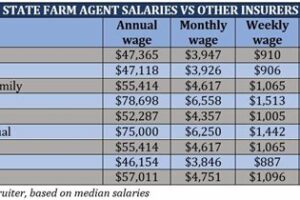

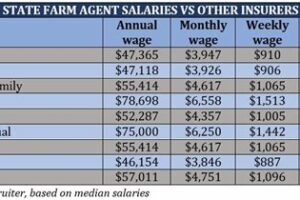

When comparing State Farm’s rideshare insurance to other insurance providers in New York State, it’s important to consider factors like coverage options, cost, and customer service. Some other insurance companies that offer rideshare coverage in New York include Allstate, Geico, and Farmers Insurance. Be sure to shop around and compare quotes before making a decision.

In conclusion, if you’re a rideshare driver in New York State, it’s essential to have proper insurance coverage to protect yourself and your passengers. State Farm offers rideshare insurance options that can help fill the gaps in your coverage, but it’s important to understand the specifics of their policies before signing up. Be sure to compare quotes and coverage options from multiple providers to find the best fit for your needs and budget.

Once upon a time, in the bustling state of New York, there was a rideshare driver named John. He loved driving for Uber and Lyft, but he always worried about what would happen if he got into an accident while on the job. That’s when he heard about State Farm’s rideshare insurance.

Excited to learn more, John did some research and found out that:

- State Farm does indeed offer rideshare insurance in New York State.

- This coverage provides protection during period 1 (when the rideshare app is on but no passengers have been accepted), period 2 (when a passenger has been accepted and is being picked up), and period 3 (when the passenger is in the car).

- The coverage includes liability, collision, and comprehensive insurance.

- State Farm’s rideshare insurance can be added on to a personal auto policy or purchased as a standalone policy.

John was thrilled to learn that he could get the coverage he needed to protect himself and his passengers while driving for Uber and Lyft. He quickly contacted his State Farm agent to add rideshare insurance to his policy.

The agent was incredibly helpful and explained everything in detail, making sure John understood all of the coverage options available to him. John felt confident and secure knowing that he was covered no matter what happened on the road.

Thanks to State Farm’s rideshare insurance, John was able to continue driving for Uber and Lyft with peace of mind, knowing that he and his passengers were protected in case of an accident.

The end.

Thank you for taking the time to read about State Farm’s rideshare insurance in New York State. We hope that this article has been helpful in answering any questions you may have had about obtaining coverage as a rideshare driver.

At State Farm, we understand the importance of having proper insurance coverage while on the road. Our rideshare insurance policies provide additional coverage for drivers who use their personal vehicles for ridesharing services. This coverage is designed to fill the gaps left by traditional auto insurance policies, which may not cover accidents that occur while driving for a ridesharing service.

If you are a rideshare driver in New York State, it is important to ensure that you have the proper insurance coverage. Without it, you could be putting yourself and your passengers at risk. With State Farm’s rideshare insurance, you can have peace of mind knowing that you are covered in the event of an accident or other unexpected incident.

Again, thank you for visiting our blog and learning more about State Farm’s rideshare insurance options in New York State. We encourage you to contact us to learn more about our coverage and how it can benefit you as a rideshare driver. Drive safely!

.

People also ask about Does State Farm Offer Rideshare Insurance In New York State?

- 1. What is rideshare insurance?

- 2. Is rideshare insurance required in New York State?

- 3. Does State Farm offer rideshare insurance in New York State?

- 4. What does State Farm’s rideshare insurance cover?

Answer:

If you’re a rideshare driver in New York State, it’s important to have the proper insurance coverage. Rideshare insurance is a type of auto insurance that provides coverage for rideshare drivers when they’re driving for a rideshare company like Uber or Lyft.

While New York State requires all rideshare drivers to carry liability insurance, it’s a good idea to consider additional coverage to protect yourself and your vehicle while you’re on the job.

Fortunately, State Farm offers rideshare insurance in New York State. This coverage can help fill in the gaps left by your personal auto insurance policy when you’re driving for a rideshare company.

State Farm’s rideshare insurance in New York State covers:

- Liability: This coverage pays for damages or injuries you cause to others while driving for a rideshare company.

- Uninsured/Underinsured Motorist: This coverage protects you if you’re in an accident with a driver who doesn’t have enough insurance to cover the damages.

- Comprehensive and Collision: This coverage pays for damages to your vehicle if you’re in an accident, regardless of who’s at fault.

Overall, if you’re a rideshare driver in New York State, it’s worth considering State Farm’s rideshare insurance to ensure you have the proper coverage while you’re on the job.