Table of Contents

Curious about the cost of insuring a Kia Soul with State Farm? Learn more about the rates and coverage options available to you.

Are you considering purchasing a Kia Soul and wondering how much insurance will cost you? Look no further than State Farm to provide you with the coverage you need. With its unique boxy design and impressive safety features, the Kia Soul has become a popular choice among drivers. However, before hitting the road, it’s important to consider the cost of insurance. Luckily, State Farm offers competitive rates and discounts for safe driving habits. But don’t take our word for it, let’s dive into what factors can affect the cost of insurance on a Kia Soul.

When it comes to purchasing a new car, there are many important factors to consider. One of the most crucial aspects is insurance. The cost of insurance can vary greatly depending on the make and model of the car, as well as other factors such as driving history and location. If you are considering purchasing a Kia Soul and are curious about how much insurance will cost, read on for more information.

What is State Farm?

Before we dive into the specifics of insurance costs for the Kia Soul, let’s first discuss what State Farm is. State Farm is one of the largest insurance companies in the United States, offering a variety of insurance products such as auto, home, and life insurance. They pride themselves on their customer service and are known for their user-friendly online tools and mobile app.

Factors that Affect Insurance Costs

There are several factors that can affect the cost of insurance for any car, including the Kia Soul. These include:

- Driving record

- Age and gender

- Location

- Credit score

- Deductible amount

- Vehicle make and model

- Safety features

Kia Soul Safety Features

One of the reasons the Kia Soul is a popular choice among car buyers is its safety features. According to the National Highway Traffic Safety Administration (NHTSA), the 2020 Kia Soul received an overall safety rating of five out of five stars. Some of the safety features included in the Kia Soul are:

- Forward collision warning

- Lane departure warning

- Automatic emergency braking

- Blind spot monitoring

- Rearview camera

How Much is Insurance on a Kia Soul with State Farm?

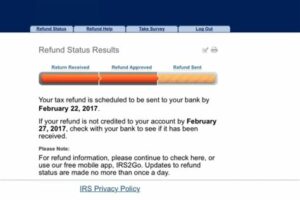

Now that we’ve covered some of the factors that can affect insurance costs, let’s take a look at how much it will cost to insure a Kia Soul with State Farm. According to State Farm, the average cost of insurance for a Kia Soul is around $100 per month or $1,200 per year.

Ways to Lower Insurance Costs

If you’re looking to lower your insurance costs for a Kia Soul with State Farm, there are several ways to do so. These include:

- Increasing your deductible

- Bundling your car insurance with other insurance products, such as home insurance

- Driving safely and maintaining a good driving record

- Installing safety features, such as a dashcam or anti-theft device

Final Thoughts

When purchasing a new car, it’s important to factor in the cost of insurance. While the cost of insurance for a Kia Soul with State Farm may vary depending on several factors, the average cost is around $100 per month or $1,200 per year. By taking steps to lower your insurance costs, such as increasing your deductible or installing safety features, you can save money in the long run.

Understanding Insurance: An Introduction to Kia Soul Coverage

If you’re the proud owner of a Kia Soul, it’s important to understand the ins and outs of insurance coverage. Accidents happen, and having adequate insurance can protect you financially in case of an unexpected mishap. Understanding your insurance options can also help you make informed decisions about the level of coverage that’s right for you.

State Farm Insurance: A Trusted Provider for Your Kia Soul

When it comes to insurance providers, State Farm is a trusted name in the industry. They offer a range of coverage options for Kia Soul owners, including liability, collision, comprehensive, and personal injury protection. With their reputation for excellent customer service and competitive rates, State Farm is a great choice for anyone looking to insure their Kia Soul.

Factors That Affect Kia Soul Insurance Rates

There are a number of factors that can impact the cost of insurance for your Kia Soul. These include your driving record, age, gender, location, and the level of coverage you choose. Additionally, the make and model of your vehicle can also affect your rates. The Kia Soul is generally considered a safe car, which can help keep insurance costs down. However, factors like the car’s age, engine size, and features (such as a sunroof or navigation system) can all play a role in determining your premiums.

Coverage Types: Which Ones Are Required for Kia Soul Owners?

In most states, there are minimum requirements for insurance coverage that drivers must meet. These typically include liability insurance, which covers damages you may cause to other people or their property while driving your Kia Soul. In addition to liability, collision and comprehensive coverage are also available options. Collision insurance covers damage to your car in the event of an accident, while comprehensive insurance covers non-collision events such as theft or fire.

Comprehensive vs. Liability Insurance: Which One Should You Choose?

Choosing between comprehensive and liability insurance depends on your individual needs and circumstances. Liability insurance is usually the minimum required by law, but it may not be enough to fully protect you in the event of an accident. Comprehensive insurance provides more comprehensive coverage, including protection against non-collision events like theft or natural disasters. Ultimately, the decision of which type of insurance to choose will depend on your budget and level of risk tolerance.

Understanding Deductibles: How They Affect Kia Soul Insurance Rates

A deductible is the amount you pay out of pocket before your insurance kicks in. Choosing a higher deductible can lower your monthly premiums, but it also means you’ll have to pay more out of pocket in the event of an accident. Conversely, choosing a lower deductible will result in higher premiums but lower out-of-pocket costs. Determining the right deductible for your Kia Soul insurance policy depends on your budget and risk tolerance.

Discounts and Savings: Tips for Lowering Your Kia Soul Insurance Premiums

There are a number of ways to save money on your Kia Soul insurance premiums. Many insurance providers offer discounts for safe driving habits, such as taking a defensive driving course or installing safety features like anti-lock brakes or airbags. Additionally, bundling your car insurance with other policies (such as home or life insurance) can also result in significant savings. Shopping around and comparing rates from multiple providers can also help you find the best deal on your Kia Soul insurance.

Comparison Shopping: Finding the Best Kia Soul Insurance Rates

When shopping for Kia Soul insurance, it’s important to compare rates from multiple providers to ensure you’re getting the best deal. Be sure to consider factors like coverage options, deductibles, and discounts when comparing rates. Additionally, don’t be afraid to negotiate with insurance providers to get the best possible rate. By doing your research and being proactive, you can find the right insurance policy for your Kia Soul at a price that fits your budget.

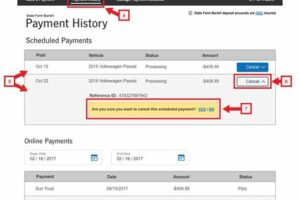

Other Considerations: Additional Expenses That May Impact Your Kia Soul Insurance

In addition to your monthly premiums, there may be other expenses associated with your Kia Soul insurance policy. These can include things like administrative fees, processing fees, and taxes. It’s important to read the fine print of your insurance policy carefully to understand all the costs associated with your coverage.

Next Steps: Choosing the Right Insurance Policy for Your Kia Soul

Choosing the right insurance policy for your Kia Soul can feel overwhelming, but by understanding your options and being proactive, you can find the coverage that’s right for you. Start by researching providers in your area and comparing rates and coverage options. Be sure to consider factors like your driving record, age, and location when making your decision. By taking the time to choose the right policy, you can drive your Kia Soul with peace of mind knowing you’re protected financially in case of an unexpected event.

As I walked into the State Farm office, I couldn’t help but wonder how much is insurance on a Kia Soul State Farm. I had just purchased my dream car, a flashy red Kia Soul, and I wanted to make sure that it was fully insured.

The friendly agent at State Farm greeted me with a smile, and I immediately felt at ease as I explained my situation. She quickly got to work, gathering all the necessary information to provide me with an accurate quote for my new car.

After a few minutes of typing and clicking away on her computer, the agent turned to me and said, Based on your driving record and other factors, we can offer you comprehensive coverage on your Kia Soul for $120 a month.

I was pleasantly surprised by the reasonable price, but I wanted to know more about what was included in the coverage. The agent patiently explained everything to me, breaking it down into easy-to-understand terms:

- Bodily injury liability: This covers the cost of medical expenses and lost wages if someone is injured in an accident that you caused.

- Property damage liability: This covers the cost of repairing or replacing someone else’s property if you damage it in an accident.

- Collision coverage: This covers the cost of repairing or replacing your own car if it is damaged in a collision with another vehicle or object.

- Comprehensive coverage: This covers the cost of repairing or replacing your car if it is damaged by something other than a collision, such as theft, vandalism, or weather-related events.

- Uninsured/underinsured motorist coverage: This covers the cost of medical expenses and lost wages if you are in an accident with someone who doesn’t have insurance or doesn’t have enough insurance to cover the damages.

Feeling confident in my choice, I signed up for the coverage and drove away in my brand new Kia Soul. Thanks to State Farm, I knew that I was fully protected on the road.

Overall, my experience with State Farm was a positive one. The agent was friendly and knowledgeable, and the price for my coverage was reasonable. I would definitely recommend State Farm to anyone looking for car insurance.

Well, folks, it’s been a pleasure discussing how much insurance on a Kia Soul costs with you all. As we’ve learned, State Farm offers a variety of coverage options for the popular compact car, and the final cost will depend on a number of factors including your location, driving history, and chosen level of coverage. But fear not, we’ve broken down some average costs to give you an idea of what to expect.

Before we sign off, let’s recap some key takeaways from our discussion. First and foremost, it’s important to shop around for insurance quotes to ensure you’re getting the best deal possible. While State Farm may be a great option for some drivers, others may find better rates elsewhere. Additionally, it’s crucial to consider the level of coverage you need based on your individual circumstances. While liability coverage is the bare minimum required by law, it may not be enough to fully protect you in the event of an accident.

Finally, don’t forget to take advantage of any discounts you may be eligible for. State Farm offers discounts for safe driving, multiple policies, and more. It never hurts to ask your agent about potential savings opportunities!

Thanks for joining us on this journey through the world of Kia Soul insurance. We hope you found the information helpful and informative. Remember to drive safely and responsibly, and always make sure you’re covered with the right insurance policy.

.

People also ask about How Much Is Insurance On A Kia Soul State Farm?

- 1. What factors affect the cost of insurance on a Kia Soul?

- 2. How much does State Farm charge for insurance on a Kia Soul?

- 3. Are there any ways to reduce the cost of insurance on a Kia Soul with State Farm?

The cost of insurance on a Kia Soul is affected by various factors such as your age, gender, driving record, credit score, location, and the coverage options you choose.

The cost of insurance on a Kia Soul varies depending on your location and other personal factors. However, according to State Farm’s website, the average cost of insurance on a Kia Soul is around $150 per month.

Yes, you can reduce the cost of insurance on a Kia Soul with State Farm by taking advantage of discounts such as safe driver discounts, multi-policy discounts, and good student discounts. You can also consider increasing your deductible or choosing a lower level of coverage to save money on premiums.

In conclusion, the cost of insurance on a Kia Soul with State Farm varies depending on your personal factors, but can be reduced by taking advantage of discounts and adjusting your coverage options.