Table of Contents

Looking for full coverage insurance? Find out how much it costs with State Farm. Get a quote today and protect your vehicle from unexpected damages.

Are you curious about how much full coverage insurance with State Farm costs? Well, buckle up because we’re about to take a deep dive into the world of comprehensive auto insurance. First and foremost, it’s important to understand that full coverage insurance typically includes liability, collision, and comprehensive coverage. These protections can offer peace of mind and financial security in the event of an accident or theft. But, as with any type of insurance, the cost of full coverage varies based on a number of factors. Let’s explore some of these factors and how they might impact your insurance premium.

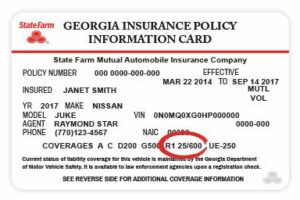

If you’re in the market for car insurance, you may be wondering how much full coverage insurance with State Farm costs. Full coverage typically includes liability, collision, and comprehensive coverage, which can provide a higher level of protection for your vehicle and finances. In this article, we’ll explore the factors that affect the cost of full coverage insurance with State Farm and give you an idea of what you might expect to pay.Factors Affecting Full Coverage Insurance Cost with State FarmSeveral factors can affect the cost of full coverage insurance with State Farm. Some of the most significant include:- Your driving record: If you have a history of accidents or traffic violations, you may pay more for car insurance.- Your age: Younger drivers typically pay more for car insurance due to their lack of experience behind the wheel.- Your vehicle: The make, model, and year of your car can impact your insurance rates. Newer or more expensive vehicles may cost more to insure.- Your location: The area where you live can affect your car insurance rates, as some areas are considered higher risk than others.- Your coverage limits: The amount of coverage you choose will impact your premiums. Higher limits typically mean higher premiums.Liability Coverage Rates with State FarmLiability coverage is the minimum legal requirement for car insurance in most states. It covers damages or injuries you cause to other people or property if you’re at fault in an accident. State Farm offers liability coverage options ranging from 25/50/25 to 250/500/100, with higher limits costing more.Collision Coverage Rates with State FarmCollision coverage pays for damages to your own vehicle if you’re in an accident, regardless of who’s at fault. State Farm’s collision coverage rates will depend on several factors, including the value of your vehicle, your deductible, and your driving record.Comprehensive Coverage Rates with State FarmComprehensive coverage protects your vehicle from non-collision incidents such as theft, vandalism, or weather-related damage. State Farm’s comprehensive coverage rates will depend on factors like the make and model of your vehicle, your deductible, and the value of your car.Discounts on Full Coverage Insurance with State FarmState Farm offers a variety of discounts that can help you save on full coverage insurance. Some of the most common discounts include:- Multi-policy discount: If you bundle your car insurance with other policies like homeowners or renters insurance, you could save up to 17% on your premiums.- Safe driver discount: If you have a clean driving record, you could qualify for a safe driver discount.- Good student discount: Students who maintain a certain GPA or are on the dean’s list may qualify for a discount on their car insurance.- Anti-theft device discount: If your vehicle has an anti-theft device installed, you could save on your premiums.Getting a Quote for Full Coverage Insurance with State FarmThe cost of full coverage insurance with State Farm will depend on several factors, and the only way to get an accurate quote is to speak with an agent. You can get a quote online or by calling a local State Farm agent. When getting a quote, be sure to provide accurate information about your driving record, vehicle, and coverage needs.Final ThoughtsFull coverage insurance with State Farm is an excellent way to protect yourself financially in case of an accident or other incident. While the cost of full coverage insurance will vary based on several factors, State Farm offers several discounts that can help you save on your premiums. Contact a local State Farm agent today to get a quote and find out how much full coverage insurance with State Farm will cost for you.

Understanding Full Coverage Insurance with State Farm: The Basics

When it comes to car insurance, there are a lot of different options to choose from. One of the most popular types of coverage is full coverage insurance. Full coverage insurance, also known as comprehensive and collision coverage, is a combination of two types of coverage that protect you and your vehicle in the event of an accident or other damage.

What’s Covered with Full Coverage Insurance from State Farm

Full coverage insurance from State Farm typically includes both collision and comprehensive coverage. Collision coverage pays for damage to your vehicle that occurs as a result of a collision with another car or object. Comprehensive coverage, on the other hand, covers damage to your vehicle that is caused by events such as theft, vandalism, or natural disasters. Full coverage insurance from State Farm may also include liability coverage, which pays for damages and injuries that you cause to other people or their property.

Determining Your Insurance Needs with State Farm

The amount of coverage you need depends on a number of factors, including your driving habits, the value of your vehicle, and your personal financial situation. State Farm recommends that you consider factors such as your budget, the type of vehicle you own, and how often you drive when determining your insurance needs.

How Much Can Full Coverage Insurance from State Farm Cost?

The cost of full coverage insurance from State Farm can vary depending on a number of factors. On average, full coverage insurance from State Farm costs around $1,500 per year. However, your actual premium may be higher or lower depending on factors such as your age, driving record, and the make and model of your vehicle.

Factors That Affect Your State Farm Full Coverage Insurance Premiums

There are several factors that can affect your State Farm full coverage insurance premiums. These include your age, gender, driving record, the make and model of your vehicle, and where you live. Younger drivers and drivers with poor driving records may pay higher premiums, while older drivers and those with clean driving records may be eligible for lower rates. Additionally, the make and model of your vehicle can affect your rates, as more expensive cars usually cost more to insure.

How to Reduce the Cost of Full Coverage Insurance with State Farm

If you’re looking to reduce the cost of full coverage insurance with State Farm, there are a few things you can do. One option is to increase your deductible, which is the amount you pay out of pocket before your insurance kicks in. Another option is to take advantage of any discounts that State Farm offers, such as safe driver discounts or multi-car discounts. You can also consider reducing your coverage limits if you feel that you don’t need as much protection as you currently have.

How to Get a State Farm Full Coverage Insurance Quote

If you’re interested in getting full coverage insurance from State Farm, the first step is to get a quote. You can do this online by visiting the State Farm website and entering some basic information about yourself and your vehicle. Alternatively, you can contact a State Farm agent directly and request a quote. It’s a good idea to get quotes from multiple providers so that you can compare rates and find the best deal.

Comparing Full Coverage Insurance Rates from State Farm with Other Providers

When shopping for full coverage insurance, it’s important to compare rates from multiple providers. While State Farm is a popular choice for many drivers, there are many other providers out there that may offer better rates or more comprehensive coverage. Some popular alternatives to State Farm include Allstate, Geico, and Progressive.

Benefits of Full Coverage Insurance with State Farm

There are several benefits to getting full coverage insurance from State Farm. First and foremost, full coverage insurance provides more comprehensive protection than basic liability coverage. With full coverage, you can rest assured that you and your vehicle are protected in the event of an accident or other damage. Additionally, State Farm offers a wide range of additional services and benefits to its customers, including 24/7 customer service and online account management.

Making Informed Decisions About Full Coverage Insurance with State Farm

Ultimately, the decision to get full coverage insurance with State Farm is up to you. By understanding the basics of full coverage insurance, determining your insurance needs, and comparing rates from multiple providers, you can make an informed decision about which type of insurance is right for you. Whether you’re a new driver or have been on the road for years, getting the right insurance coverage can provide invaluable peace of mind and protection.

Once upon a time, there was a young driver named Sarah who just purchased her first car. Excited to hit the road, Sarah knew that she needed to get insurance before she could drive legally. She researched different insurance companies and heard great things about State Farm’s full coverage insurance.

Curious about how much it would cost, Sarah contacted her local State Farm agent and asked for a quote. She was pleasantly surprised by how easy the process was and how affordable the rates were for full coverage insurance.

Here are some factors that determine how much full coverage insurance with State Farm costs:

- The type of car: The make, model, and year of your car will affect the cost of your insurance. Newer and more expensive cars will typically cost more to insure.

- Your driving record: If you have a clean driving record with no accidents or violations, you’ll likely pay less for insurance.

- Your age and gender: Younger drivers and male drivers statistically have a higher risk of accidents, which can lead to higher insurance rates.

- Your location: Where you live can affect your insurance rates due to factors like crime rates and weather conditions.

- Your coverage limits: The more coverage you want, the more you’ll pay for insurance.

After discussing these factors with her State Farm agent, Sarah was able to customize her full coverage insurance policy to fit her needs and budget. She opted for higher coverage limits and added features like roadside assistance and rental car coverage.

Overall, Sarah was happy with her decision to choose State Farm for her full coverage insurance. She felt confident knowing that she was protected in case of any accidents or incidents on the road. Plus, the affordable rates made it easy for her to budget for her insurance payments each month.

So if you’re in the market for full coverage insurance, don’t hesitate to contact State Farm and get a quote. You may be surprised by how much peace of mind you can get for an affordable price.

Thank you for taking the time to read our article on how much full coverage insurance costs with State Farm. We know that navigating the world of insurance can be confusing and overwhelming, which is why we strive to provide clear and concise information that can help you make informed decisions about your coverage.As we discussed earlier, the cost of full coverage insurance with State Farm can vary depending on a number of factors, including your age, driving history, location, and the type of vehicle you drive. However, by working with a State Farm agent, you can get a personalized quote that takes all of these factors into account and helps you find the coverage that’s right for you.While full coverage insurance may be more expensive than liability-only coverage, it provides added peace of mind and protection in the event of an accident or other unforeseen circumstances. With State Farm, you can customize your coverage to meet your specific needs and budget, whether you’re looking for comprehensive coverage, collision coverage, or both.At the end of the day, the cost of full coverage insurance depends on a variety of factors, and there’s no one-size-fits-all answer. However, by working with a knowledgeable and experienced State Farm agent, you can find the coverage that’s right for you and your budget. So if you’re in the market for full coverage insurance, don’t hesitate to reach out to State Farm today and start exploring your options..

When it comes to auto insurance, many people wonder about the cost of full coverage insurance with State Farm. Here are some common questions and answers:

-

What is full coverage insurance with State Farm?

Full coverage insurance with State Farm typically includes liability insurance, collision insurance, and comprehensive insurance. This type of insurance can help protect you financially in case of accidents, theft, or damage to your vehicle.

-

How much does full coverage insurance with State Farm cost?

The cost of full coverage insurance with State Farm can vary depending on several factors, such as your age, driving history, location, and the type of car you drive. On average, full coverage insurance with State Farm can cost around $1,500 to $2,000 per year.

-

Is full coverage insurance with State Farm worth it?

Whether or not full coverage insurance with State Farm is worth it depends on your personal situation and risk tolerance. If you have a new or expensive car, live in an area with high rates of car theft or damage, or have a history of accidents or tickets, full coverage insurance may be a wise investment. However, if you have an older car that is not worth much, you may be better off with just liability insurance.

-

How can I save money on full coverage insurance with State Farm?

There are several ways to potentially save money on full coverage insurance with State Farm, such as:

- Bundling your auto insurance with other types of insurance, such as home or life insurance

- Choosing a higher deductible

- Taking advantage of discounts for safe driving, good grades, or being a member of certain organizations

Overall, full coverage insurance with State Farm can provide valuable protection and peace of mind on the road. It’s important to shop around and compare quotes to find the best coverage and price for your individual needs.