Curious about how much State Farm insurance costs every 6 months? Get a quote today and find out how affordable coverage can be!

Are you wondering how much State Farm Insurance costs every six months? Well, look no further because we have all the answers you need! Let’s face it, insurance can be a headache and trying to find the right coverage at an affordable price can seem like an impossible task. But with State Farm, you can rest assured that you are getting the best value for your money. Plus, their policies come with unbeatable benefits that will give you peace of mind no matter what life throws your way.

Understanding Your Insurance Costs: State Farm Rates

When it comes to insurance costs, State Farm is one of the most popular providers. However, the cost of State Farm insurance can vary depending on a variety of factors. It’s important to understand these factors in order to determine how much you’ll be paying every six months.

What Affects the Cost of Your State Farm Insurance?

There are several factors that can affect the cost of your State Farm insurance. For example, your location can play a significant role in determining your rates. Additionally, your age and driving record can also impact the cost of your policy. The type of vehicle you drive and how you use it can also affect your State Farm insurance rates. Finally, the amount of coverage you need will also play a role in determining your premiums.

The Importance of Shopping around for State Farm Insurance Quotes

Given the variety of factors that can impact your State Farm insurance rates, it’s important to shop around for quotes. By getting multiple quotes from different providers, you can compare rates and find the best deal for your needs. This can help you save money and ensure that you’re getting the right amount of coverage.

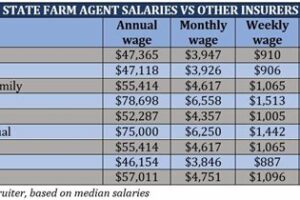

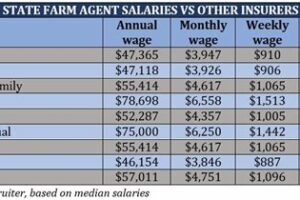

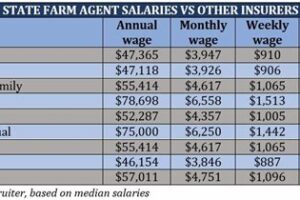

Comparing State Farm Rates with Other Insurance Providers

When shopping around for insurance, it’s important to compare State Farm rates with other providers. This can give you a better idea of what you should be paying for coverage. Additionally, it can help you identify any areas where you may be able to save money on your policy.

Saving Money on State Farm Insurance: Discounts & Bundling Options

One way to save money on your State Farm insurance is to take advantage of discounts and bundling options. For example, if you have multiple policies with State Farm, you may be able to bundle them together and save on your premiums. Additionally, there are a variety of discounts available for things like safe driving and good grades. By taking advantage of these options, you can lower your insurance costs.

Why Your Location Affects State Farm Insurance Costs

Your location can play a big role in determining your State Farm insurance rates. For example, if you live in an area with high crime rates or a high incidence of accidents, you may be charged more for coverage. Additionally, the cost of living in your area can also impact your premiums.

Balancing Your Coverage Needs with State Farm Premiums

When choosing your State Farm insurance policy, it’s important to balance your coverage needs with your premiums. You want to make sure that you have enough coverage to protect yourself in the event of an accident, but you also don’t want to pay more than you need to for your policy.

The Role of Your Age and Driving Record in State Farm Insurance Rates

Your age and driving record are two of the biggest factors that can impact your State Farm insurance rates. Generally speaking, younger drivers and those with poor driving records will pay more for coverage. However, there are ways to offset these costs, such as taking a defensive driving course or maintaining a good driving record over time.

How Your Vehicle Type and Use Affects State Farm Insurance Costs

The type of vehicle you drive and how you use it can also impact your State Farm insurance rates. For example, if you drive a high-end luxury car, you’ll likely pay more for coverage than if you drive a more affordable model. Additionally, if you use your car for business purposes, you may be charged more for coverage.

Navigating State Farm Insurance Pricing for Homeowners and Renters

If you’re a homeowner or renter, you may also need to purchase insurance from State Farm to protect your property. The cost of this insurance will vary depending on a variety of factors, including the location of your property, the value of your possessions, and the level of coverage you need. By working with a State Farm agent, you can get a better understanding of how much you’ll be paying for this insurance and what options are available to you.Overall, it’s important to take the time to understand your State Farm insurance costs and find ways to save money on your policy. By doing so, you can ensure that you’re getting the coverage you need without breaking the bank.

Once upon a time, there was a young adult named Sarah who was excited to purchase her first car. She had saved up enough money to buy a used car and was eager to hit the road. However, before she could do so, she needed to purchase car insurance.

Sarah had heard good things about State Farm Insurance from her family and friends, so she decided to get a quote from them. She visited their website and filled out the necessary information about her car and driving history. After a few moments, she received a quote for how much it would cost to have State Farm Insurance for six months.

The number that appeared on her screen left her feeling surprised and relieved. The cost was reasonable, and Sarah felt like she could afford it. But just to be sure, she decided to do some research to see if the price was competitive with other insurance companies.

What she found was impressive. State Farm Insurance was known for its affordable rates and excellent customer service. Sarah felt confident in her decision to go with State Farm Insurance and purchased her policy right away.

Here are some key points about How Much Is State Farm Insurance Every 6 Months:

- The cost of State Farm Insurance varies depending on factors such as your age, location, driving history, and the type of car you own.

- State Farm Insurance offers discounts for safe driving, multiple cars, and bundling policies.

- The average cost of State Farm Insurance every six months is around $750, but this can vary.

- It’s important to shop around and compare prices before choosing an insurance company.

In conclusion, Sarah was happy with her decision to go with State Farm Insurance. The cost was reasonable, and she knew she was getting a good deal. If you’re in the market for car insurance, it’s worth considering State Farm Insurance and getting a quote to see how much it would cost for you.

Hello there, dear blog visitors! I hope you’ve enjoyed reading about how much State Farm insurance costs every 6 months. Before we say goodbye, let’s summarize what we’ve learned so far.

Firstly, we found out that the cost of State Farm insurance greatly varies depending on several factors such as your location, age, gender, driving record, and the type of coverage you need. We also discovered that while State Farm is known for being one of the most expensive insurance providers in the market, it also offers various discounts and perks that can help lower your premium.

Now that you have a better understanding of how State Farm insurance pricing works, you can make an informed decision on whether or not it’s the right insurance provider for you. Remember to always do your research and compare quotes from different companies before making a final decision.

Thank you for visiting our blog and taking the time to read about State Farm insurance pricing. We hope that you found this article helpful and informative. Don’t forget to check out our other articles for more insurance-related topics. Until next time!

.

As one of the largest insurance providers in the United States, State Farm Insurance offers a wide range of coverage options for individuals, families, and businesses. One common question that people ask is:

How much is State Farm Insurance every 6 months?

There is no one-size-fits-all answer to this question, as the cost of State Farm Insurance can vary depending on several factors. However, here are some key factors that can affect the cost of State Farm Insurance every 6 months:

- Type of Coverage: State Farm offers a variety of insurance policies, including auto, home, renters, life, and more. The cost of your insurance will depend on the type of coverage you choose.

- Deductible: The deductible is the amount you pay out of pocket before your insurance kicks in. Choosing a higher deductible can lower your monthly premiums, but it also means you’ll pay more if you need to file a claim.

- Location: The cost of insurance can vary depending on where you live. Factors like crime rates, weather patterns, and population density can all impact the cost of your insurance.

- Driving Record: If you’re applying for auto insurance with State Farm, your driving record will play a significant role in determining your rates. Drivers with clean records can expect to pay less than those with accidents or traffic violations on their record.

- Credit Score: In most states, State Farm uses credit score as a factor in determining insurance rates. Those with good credit scores can expect to pay less than those with poor credit scores.

While there is no set cost for State Farm Insurance every 6 months, the best way to get an accurate estimate is to request a quote from State Farm directly. By providing information about your coverage needs, location, and driving history, you can get a personalized quote that reflects your unique situation.

Overall, State Farm Insurance offers competitive rates and a variety of coverage options to meet your needs. Whether you’re looking for auto insurance, home insurance, or another type of coverage, State Farm can help you find the right policy at a price that fits your budget.