Table of Contents

State Farm stays competitive with online insurance companies by offering personalized service, strong brand recognition, and a variety of coverage options.

As the world evolves and shifts towards digitalization, online insurance companies have become increasingly popular. However, traditional insurance companies like State Farm remain relevant in the industry by constantly adapting to changing market demands. While many customers are lured towards the convenience of purchasing insurance policies online, State Farm has managed to compete with these companies by offering a personalized approach to customer service. Despite the heavy competition from online insurance providers, State Farm has been able to maintain its reputation as one of the leading insurance companies in the country through its exceptional customer service, reliable policies, and innovative products.

State Farm Insurance is one of the largest insurance companies in the United States, and it has been around for nearly 100 years. It offers a wide range of insurance products, including auto, home, and life insurance. Despite the rise of online insurance companies, State Farm has managed to compete by focusing on its strengths and finding new ways to connect with customers. In this article, we will explore how State Farm competes with online insurance companies.

The Importance of Personalized Service

One of the most significant advantages of State Farm over online insurance companies is the personalized service it offers. State Farm has a vast network of agents and customer service representatives who are available to help customers with any questions or concerns they may have.

Customers can visit a State Farm office and speak with an agent face-to-face, which is something that online insurance companies cannot offer. This personalized service helps build trust and loyalty with customers, which is essential in the insurance industry.

Innovative Technology

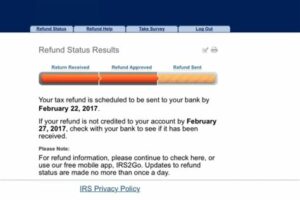

While State Farm prides itself on its personalized service, it also recognizes the importance of technology. The company has developed innovative tools and resources to help customers manage their policies and claims online.

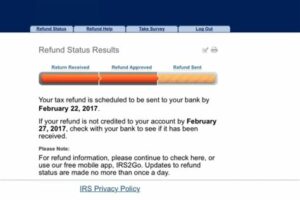

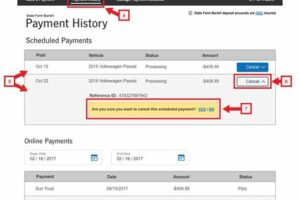

State Farm has a mobile app that allows customers to access their policies, pay bills, file claims, and even request roadside assistance. The app has received high ratings from customers, and it demonstrates the company’s commitment to providing convenient solutions for its customers.

Competitive Pricing

One of the main reasons why customers turn to online insurance companies is because of their low prices. However, State Farm has managed to remain competitive by offering affordable rates and discounts to its customers.

The company offers a variety of discounts, such as safe driver discounts, multiple policy discounts, and even discounts for good grades. These discounts help customers save money while still receiving the personalized service that State Farm is known for.

Community Involvement

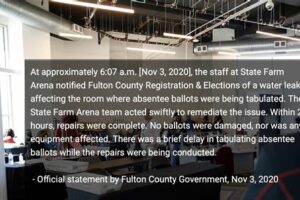

State Farm is committed to giving back to the communities it serves. The company provides support for various charitable organizations and encourages its employees to volunteer their time and resources.

By being involved in the community, State Farm demonstrates its commitment to helping people and making a positive impact. This involvement helps build trust and loyalty with customers, who appreciate a company that cares about more than just profits.

Brand Recognition

State Farm has been around for nearly 100 years, and it has built a strong brand that is recognized across the country. This brand recognition helps the company compete with online insurance companies that may not have the same level of recognition.

Customers are more likely to choose a company they recognize and trust, and State Farm’s brand recognition gives it an advantage over newer, online insurance companies.

The Importance of Trust

Trust is essential in the insurance industry, and State Farm has worked hard to establish a reputation as a company that customers can trust. The company’s personalized service, innovative technology, competitive pricing, community involvement, and brand recognition all contribute to building trust with customers.

Customers know that if they have an issue or need assistance, State Farm will be there to help them. This trust is not easily earned, but State Farm has managed to maintain it for nearly 100 years.

The Future of State Farm

State Farm has faced many challenges over the years, but it has always found ways to adapt and thrive. The rise of online insurance companies is just one of the many challenges the company has faced, but it has managed to remain competitive by focusing on its strengths and finding new ways to connect with customers.

As the insurance industry continues to evolve, State Farm will undoubtedly face new challenges. However, the company’s commitment to personalized service, innovative technology, competitive pricing, community involvement, brand recognition, and trust will continue to set it apart from online insurance companies and other competitors.

Conclusion

State Farm Insurance is a company that has been around for nearly 100 years, and it has built a reputation as a company that customers can trust. Despite the rise of online insurance companies, State Farm has managed to compete by focusing on its strengths and finding new ways to connect with customers.

The company’s personalized service, innovative technology, competitive pricing, community involvement, brand recognition, and trust all contribute to its success. As the insurance industry continues to evolve, State Farm will undoubtedly face new challenges, but its commitment to its customers and its core values will continue to set it apart from other companies.

When it comes to competing with online insurance companies, State Farm has a few tricks up their sleeve. First and foremost, they offer customer service that goes above and beyond. Customers have access to personalized support from knowledgeable agents who can quickly address their concerns. State Farm agents are highly trained and skilled in all areas of insurance, providing customers with valuable expertise and advice. Additionally, State Farm provides coordinated claims support through a dedicated claims center and insurance agent. This ensures that claims are processed efficiently and seamlessly. State Farm agents are also located in communities across the country, providing them with local knowledge and connections. This can be especially useful for customers with specialized insurance needs, such as homeowners in high-risk flood zones. State Farm offers a range of insurance coverage options, including specialized coverage options like their Drive Safe and Save program. They have also integrated smart technology into their offerings, including mobile apps for easy policy management and claims filing.State Farm recognizes the importance of online tools and resources, offering convenient online resources like quotes and policy management. But what sets them apart from online insurance companies is their personalized advice and guidance. State Farm agents provide tailored recommendations based on each customer’s unique needs, rather than relying on algorithms. For small business owners, State Farm offers specialized insurance services like liability coverage, property insurance, and workers’ compensation insurance. And perhaps most importantly, State Farm has built a trusted reputation over several decades in the industry. Their solid track record of customer satisfaction and reliability make them a trusted partner for customers seeking comprehensive insurance coverage.

State Farm is one of the largest insurance companies in the world, with over 19,000 agents and 83 million policies in force. However, in recent years, online insurance companies have emerged as a major competitor to traditional brick-and-mortar insurers like State Farm. So, how does State Farm compete with online insurance companies?

1. Personalized service:

- One of the key ways that State Farm competes with online insurance companies is by offering personalized service. State Farm customers can work directly with an agent who will help them choose the right coverage options for their needs. This level of personalized service is not available from most online insurance companies.

- State Farm agents are also available to help customers with claims, which can be a major advantage over online insurers. If you have a claim, you can call your State Farm agent and they will help you through the process, which can be much easier than dealing with an online insurer.

2. Competitive pricing:

- While online insurance companies are often known for their low prices, State Farm is also competitive when it comes to pricing. In fact, State Farm offers discounts for safe driving, multiple policies, and other factors that can help customers save money on their insurance.

- State Farm also has a strong financial rating, which means that they are able to offer competitive pricing without sacrificing coverage or service.

3. Brand recognition:

- State Farm is a well-known brand with a long history of providing reliable insurance coverage. Many customers choose State Farm because they trust the brand and feel confident that they will receive good service and coverage.

- In contrast, many online insurance companies are relatively new and do not have the same level of brand recognition or reputation as State Farm.

4. Technology:

- While State Farm may not be an online-only insurance company, they have invested heavily in technology to make it easier for customers to manage their policies and claims.

- State Farm’s mobile app allows customers to view their policies, pay bills, and file claims from their phones or tablets. This can be a major advantage over online insurers that may not offer these features.

In conclusion, State Farm competes with online insurance companies by offering personalized service, competitive pricing, strong brand recognition, and advanced technology. While online insurance companies may offer some advantages, State Farm has proven that traditional insurers can still compete in today’s digital age.

Hello and thank you for taking the time to read about how State Farm competes with online insurance companies. As you may have learned from this article, State Farm has adapted to the changing landscape of the insurance industry by offering a variety of digital tools and services to their customers.

While online insurance companies may offer convenience and lower prices, State Farm places a strong emphasis on personal relationships with their customers. Their extensive network of agents and personalized service sets them apart from other insurance providers. Additionally, State Farm’s financial stability and strong reputation in the industry provide peace of mind to customers who value security and reliability.

State Farm understands that the world is constantly evolving and they strive to stay ahead of the game by continuously improving their services and offerings. They have invested heavily in technology to make their policies easily accessible and to provide their customers with the best possible experience. Whether it’s through mobile apps, online resources, or face-to-face interactions with their agents, State Farm is committed to giving their customers the support they need.

Thank you again for reading about how State Farm competes with online insurance companies. If you’re looking for a reliable and trustworthy insurance provider, be sure to consider State Farm and all they have to offer. With their combination of personalized service, financial stability, and innovative technology, they are well-equipped to meet the needs of today’s consumers.

.

As online insurance companies continue to gain popularity, many people are curious about how State Farm competes in the digital age. Here are some of the most frequently asked questions about State Farm’s competition with online insurance companies:

1. How does State Farm compare to online insurance companies in terms of price?

State Farm’s prices are competitive with those of online insurance companies. In fact, State Farm often offers discounts for bundling policies, such as combining home and auto insurance. Additionally, State Farm has a network of local agents who can help customers find the best coverage at the best price.

2. Does State Farm offer the same level of convenience as online insurance companies?

Yes, State Farm offers many of the same conveniences as online insurance companies. Customers can manage their policies online or through the State Farm mobile app, and claims can be filed and tracked digitally. However, State Farm also has the added benefit of having local agents who can provide personalized support and guidance.

3. How does State Farm’s customer service compare to that of online insurance companies?

State Farm is known for its excellent customer service, which is provided by both local agents and a dedicated customer service team. While some online insurance companies may have good customer service, State Farm’s local agents offer a level of personal attention and expertise that cannot be matched by purely digital interactions.

4. What sets State Farm apart from online insurance companies?

One of the biggest things that sets State Farm apart from online insurance companies is its network of local agents. These agents can provide personalized support and guidance to customers, and can help them navigate the sometimes confusing world of insurance. Additionally, State Farm has a long-standing reputation for reliability and financial stability, which gives customers peace of mind.

In conclusion, while online insurance companies are certainly competitors to State Farm, the company has many strengths that allow it to compete in the digital age. With competitive prices, convenient digital tools, and personalized support from local agents, State Farm is well-positioned to meet the needs of modern insurance customers.